PFM Success Factors

Product Manager Nathalie Stenger being interviewed

Product Manager Nathalie Stenger being interviewed

From Understanding to Action: Success Factors for Personal Finance Management

Digital finance cockpits for Personal Finance Management (PFM) offer considerable benefits – for both banking customers and the banks themselves. However, for these benefits to truly materialise, financial institutions need to consider several key factors during implementation.

In this interview, Contovista Product Manager Nathalie Stenger explains why high user adoption is crucial for PFM success and which best practices help achieve this goal. In her view, successful PFM implementation requires delivering effective solutions for relevant customer needs and ensuring deep integration into everyday banking. Equally important, however, is clear and targeted communication.

Only High User Adoption Creates Real Value

With its AI Personal Finance Manager, Contovista offers a powerful tool for digital banking. To begin broadly: what added value does this bring to financial institutions and their retail customers?

The greatest added value comes from a data-driven, personalised financial overview. For banking customers, this means gaining insights that would otherwise be difficult to obtain – such as identifying spending patterns and how these change over time.

For banks, Contovista’s AI Personal Finance Manager unlocks additional potential: improved advisory services thanks to analytical insights, new cross-selling and up-selling opportunities, and stronger customer loyalty. The decisive factor here is user adoption. The more intensively the tool is used, the greater the individual benefit – and the more valuable the data becomes for the bank. Achieving high user adoption should therefore be one of the core goals of any implementation strategy.

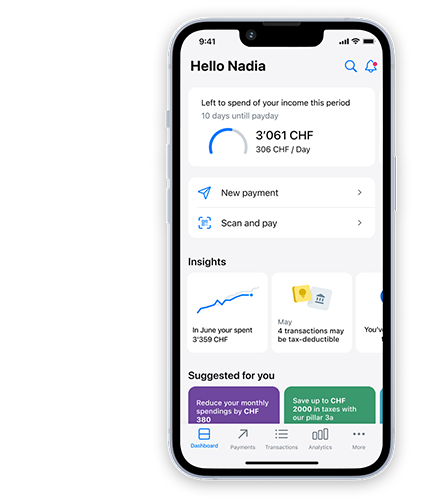

Figure: Deep integration of PFM in the dashboard.

And what conditions must be met for customers to use the PFM tool consistently?

Several aspects are important. The financial cockpit must deliver a concrete benefit to customers. However, powerful value-added features alone are not enough.

High user adoption also requires prominent and seamless integration into web and mobile banking. The challenge: banks often fail to actively communicate the PFM’s value. This needs to be counteracted through a suitable strategy that clearly highlights which specific customer pain points the finance assistant resolves. The key prerequisites for PFM success are therefore: high everyday relevance, deep integration, and easy-to-understand communication.

Image: Nathalie Stenger, Product Manager at Contovista, being interviewed.

Instant “Aha” Moments Through Relevant Banking Insights

How can banks ensure strong everyday relevance?

Customers will only use PFM tools regularly if they consistently feel that the tool offers them real value – and that this value is effortless to access. Using the tool should involve as little effort as possible. Immediate “aha” moments significantly increase the incentive to use a PFM tool on a regular basis.

Already in the first session, the tool needs to impress and make it clear why its use is worthwhile: through personalised financial insights that would not be possible without PFM, such as predictions for improved financial planning.

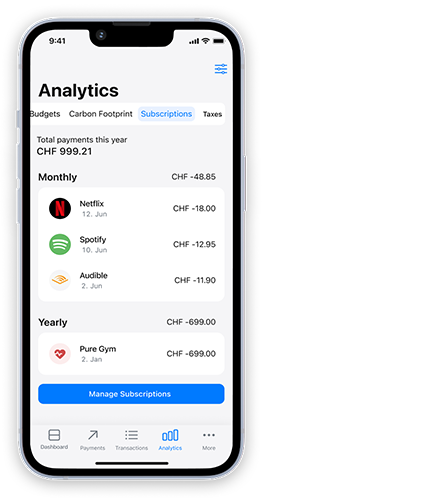

Illustration: Transparent overview of all subscriptions.

Automatically categorised expenses with clear visualisations – for example, how last month’s salary was spent, or a transparent overview of subscriptions – make personal spending behaviour visible. This enables banking customers to adjust their spending in line with their financial goals.

Accuracy in categorisation is particularly important here. It is crucial for users’ trust in the tool. Providing insights is only the first step. Equally important is delivering suitable recommendations for action straight away.

Concrete Recommendations Increase Engagement Rates

So it’s about moving from understanding to taking action. How is this achieved in practice with Contovista’s AI Finance Cockpit?

Financial insights are supplemented with simple, immediately actionable tips, such as saving suggestions or budgeting hints. This motivates users to actually change their behaviour. Our data clearly shows: personalised, easy-to-understand prompts significantly increase engagement rates.

What matters here is restraint: a few relevant nudges are far more effective than an overload of information.

As a UX expert, you always consider the user experience when defining best practices for PFM. What makes the perfect user experience?

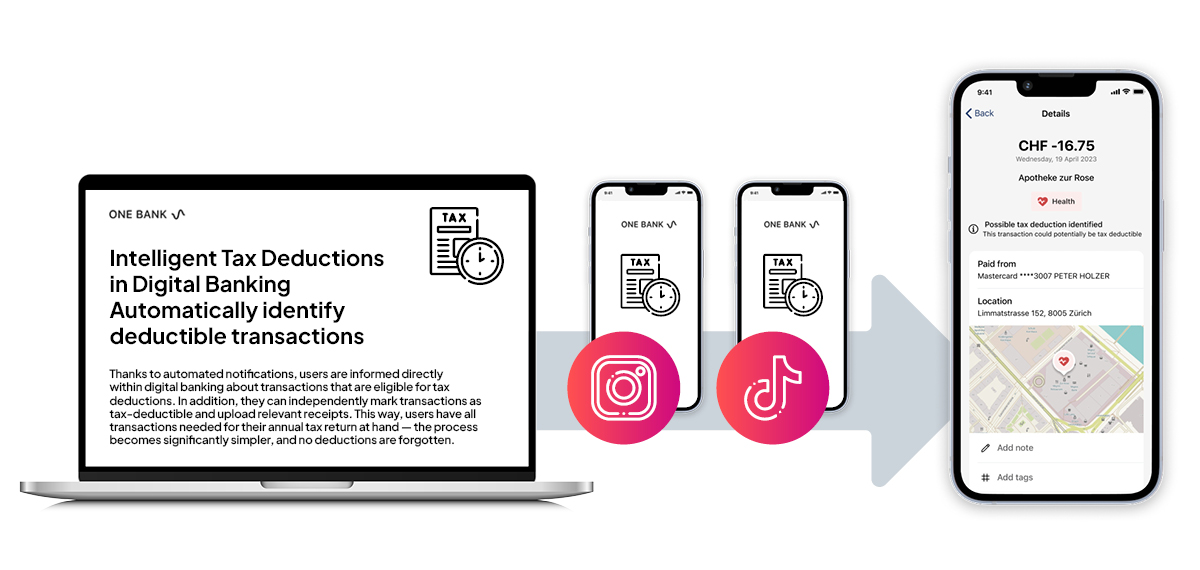

This brings us to the second point I mentioned earlier: deep integration of the PFM into digital banking. A PFM should not be an isolated feature hidden in a separate tab; it should also be integrated into the right context. In this way, the tool becomes “invisibly visible” for customers. Insights and recommendations are provided at exactly the right moment – for example, when tax season begins and our Tax Feature (i.e., Intelligent Tax Deductions) helps customers identify all relevant deductible transactions. This makes the finance assistant a true companion in everyday life.

Customer-Centred Communication Is Essential

As you mentioned earlier, successful PFM implementation also requires an appropriate communication strategy. What is important here?

Exactly! Customers rarely visit digital banking platforms to actively search for new features. That’s why communication must take place across multiple channels – and in a context-based manner, so customers are reached at the right moment.

Illustration: Multichannel communication on PFM value-added features in digital banking.

Many banks already have strong customer touchpoints such as social media, newsletters or customer magazines. This presents a major opportunity: it’s not about presenting PFM as an isolated “super tool”.

It is far more effective to embed PFM into existing topics. If a bank publishes content on “budget planning”, it should not recommend Excel templates, but instead point out that a relevant feature is already available within its digital banking offering.

Our experience shows that there is often a gap between product and marketing. This gap needs to be closed so that PFM is not only technically available, but also truly perceived and used.

And what role does the analogue “offline” world play in communicating PFM – in other words, personal advisory meetings?

Personal advisory services remain an important channel as well! Many customers appreciate personalised advice from their bank. However, advisers often know too little about PFM features and fail to mention them. Targeted information materials can help staff build this knowledge. When advisers are familiar with the PFM, they can specifically point customers towards it – and benefit themselves from the analytical insights. This enables more individual conversations, better solutions, and ultimately higher customer satisfaction.

Digital innovation continues to bring new solutions and approaches. Which developments will shape the market in the coming years?

A major topic remains Open Finance and multibanking. Personal financial data is increasingly consolidated in one place via interoperable interfaces. Banking customers will then operate through a central “One Finance Hub”, where they carry out all financial activities. Within this hub, they will also use more data-driven value-added services. This includes “Beyond Banking”, meaning the use of non-financial services. The trend from understanding to action is evolving more and more towards automation.

Customers expect not only recommendations, but also automatic execution – such as budget optimisations or saving transfers powered by agentic AI.

At Contovista, we have already implemented a form of such automation within the AI Personal Finance Manager (PFM) through the Smart Balance Optimiser in the spirit of “self-driving money”.

The PFM of the future will be a true financial co-pilot: proactive, adaptive, transparent and action-oriented.

Thanks for the chat, Nathalie!