Enrichment Engine

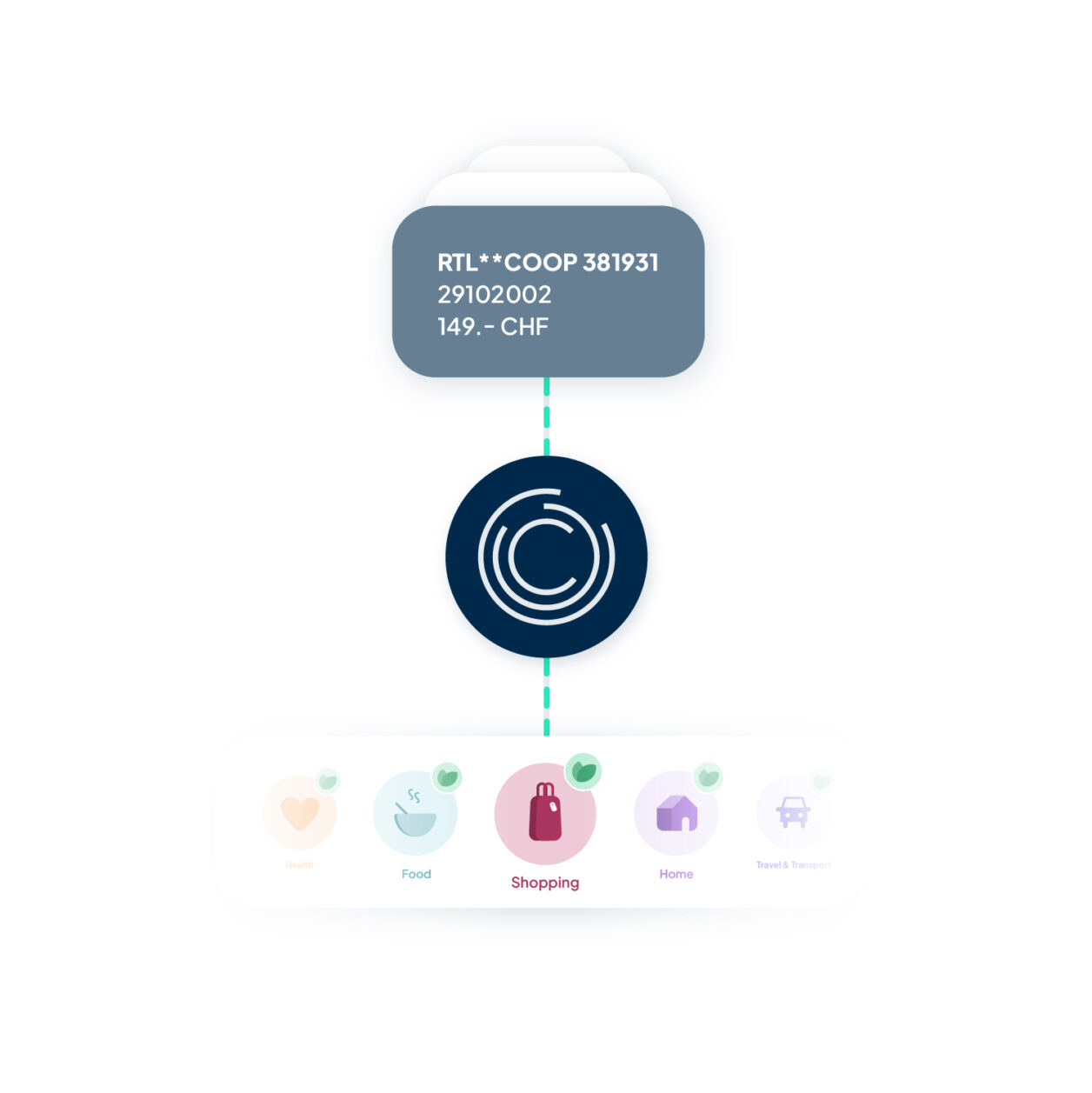

Thanks to AI and extensive industry experience, we interpret and refine unstructured transaction data into useful information and decision-relevant insights with the highest accuracy.

Thanks to AI and extensive industry experience, we interpret and refine unstructured transaction data into useful information and decision-relevant insights with the highest accuracy.

Contact our expertsTransaction enrichment and customer insights

Contovista’s leading transaction categorisation structures payment information and intelligently enriches it with relevant metadata. This allows financial institutions to gain deep insights into almost all aspects of their clients’ lives. As a result, they can precisely understand client behaviour and develop personalised financial offers.

Enhanced data quality

By improving data quality for data science and analytics teams, banks can optimise their sales strategies, personalise advice, and create more precise risk assessments. Doing so leads to increased client satisfaction and higher user engagement. Additionally, financial institutions can directly integrate deep Enrichment Engine transaction insights into their advisory tools or other channels to provide even more targeted and valuable services to their customers.

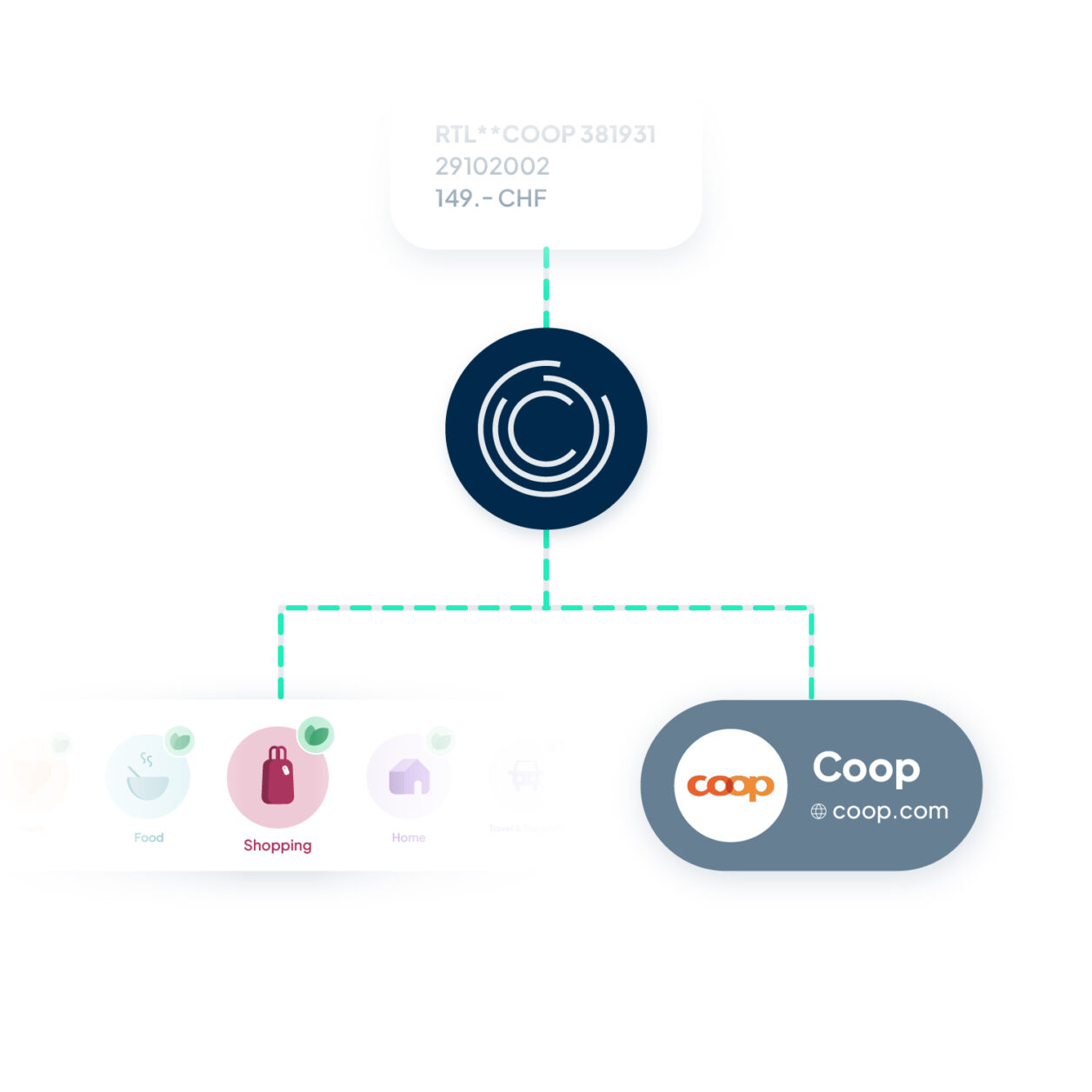

Contovista’s Enrichment Engine analyses transactions from a wide range of payment methods (bank transfers, card payments, Twint, Sepa, SWIFT etc.) and sources (core banking system) and assigns them to detailed transaction categories. By adding merchant IDs, pretty names, logos, and geodata that comply with the Mastercard guidelines (Mandate 4569), we enable financial institutions to conduct in-depth analyses of their clients’ financial data.

Maximum Accuracy

Precise categorisation of over 240 categories, including hairdresser, petrol station, bike shop, and supermarket, as well as merchant IDs, logos, and intuitive pretty names.

Shared Learning Effect

Continuous improvement of transaction data enrichment through a network effect from anonymised data from our partner banks.

All Payment Methods

Recording of all common payment methods and means (Sepa & SWIFT) including QR-bill, eBill, Twint, debit and credit cards, PayPal, bank transfer, and much more.

Utilize the power of transaction data

Transaction and counterparty categories

We automatically categorise over 240 categories (e.g. rent) and identify over 1,000 counterparty categories (e.g. pharmacy versus drugstore) with a hit rate of 98%. This gives financial institutions valuable insights into the habits of their clients, enabling them to hyper-personalise their offerings and generate meaningful data for their machine learning models

Merchant information and pretty names

By enriching merchant IDs with pretty names and logos, in strict compliance with Mastercard guidelines (Mandate 4569), banks can offer their clients an even more detailed and personalised overview of their transactions.

Geolocation with map view

Geolocation provides invaluable location information (longitude and latitude) as well as detailed map views for physical card payments. This allows banks to not only offer their customers a better overview, but also to further personalise the user experience.

Simple integration with maximum flexibility

The Enrichment Engine is independent of your core banking system and available as an on-premise or SaaS solution. It can be easily integrated into your IT landscape via a REST API or with an individual DB interface.

Client advisory services and sales

Seamless integration of the enriched transaction data into existing customer advisor systems (Advisor Workbench) and tools gives banks a comprehensive overview of their clients.

This enables advisory services to be further personalized and sales processes to be optimized. Moreover, banks can harness patterns in enriched transaction data to build detailed client profiles for targeted marketing and lead generation, drawing on purchasing behaviour, habits, and geolocation data.

Further optimise sales and client advice with client analytics

More efficient risk management

With the help of the Enrichment Engine, it is possible to identify existing alimony payments, relationships with third-party providers (TTP), debt collection, or a client’s tendency toward gambling.

Comprehensive credit rating models can be developed by leveraging the deep transaction insights of the Enrichment Engine, while risk and creditworthiness assessments can be enhanced.

Enhancing operational efficiency

Enriched transaction data offers insights into clients’ salaries, rental incomes, taxes, mortgages, and deeper aspects of their behaviors and interests.

These insights can be integrated to fully automate risk and marketing processes, including loan approvals and marketing campaigns.

Automate risk and marketing processes with client analytics.

Structured and usable transaction data

Our structured and enriched transaction data enables analytics teams to gain deep insights and make data-driven decisions. By using machine learning models trained on the extensive datasets of the Enrichment Engine, clients with high conversion potential can be identified, and hyper-personalised marketing campaigns can be executed.

Case studies with our partner banks show:

- Up to 23 times higher conversion rates for credit cards

- A doubling of loan applications

- 35% more investments in securities

- Identification of clients with a high potential for closing a deal

Creating a better customer experience

Our transaction data enrichment provides structured and enriched data that is transformed into actionable insights.

This information is provided via the Personal Finance Manager in digital banking, enabling clients to better understand their financial situation and manage their finances more efficiently.