Carbon Footprint Manager

Calculates the carbon footprint of users and provides them with information on their emissions in the most important transaction categories along with relevant tips and insights.

Calculates the carbon footprint of users and provides them with information on their emissions in the most important transaction categories along with relevant tips and insights.

Contact our experts

Transaction-based CO₂ calculations

The Carbon Footprint Manager is an add-on module for the AI Personal Finance Manager (PFM). It analyses all transaction data and calculates the corresponding carbon footprint (key figure: kilograms of CO₂ emissions in relation to the transaction amount in CHF). It calculates an individual’s carbon footprint based on transactions and sets their personal CO₂ consumption in relation to the Swiss average.

High-quality Swiss climate data

Understanding and improving CO₂ consumption

We use more than 90 data sources and methods to calculate an individual’s CO₂ footprint. CO₂ consumption can be broken down by month or year and is automatically assigned to one of the following categories: Food, Home, Travel & Transport, Shopping, and Health & Leisure.

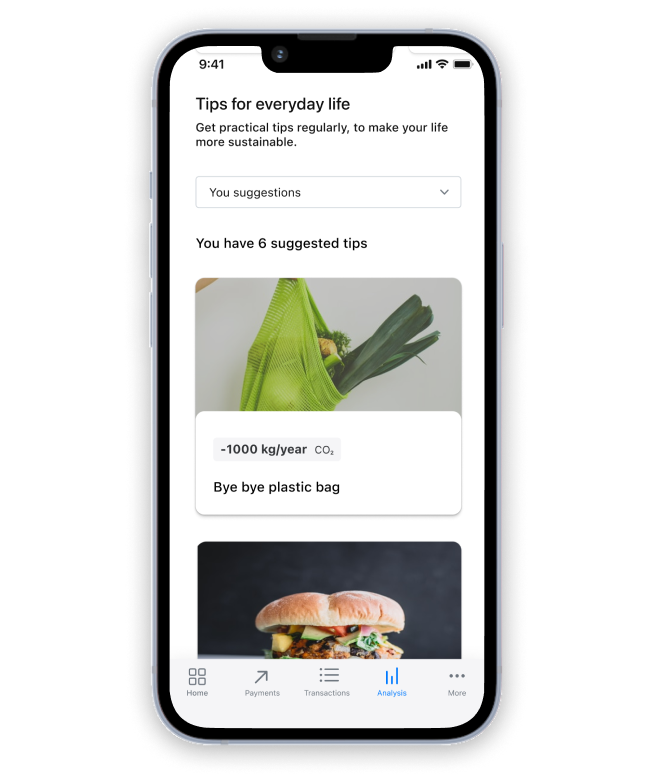

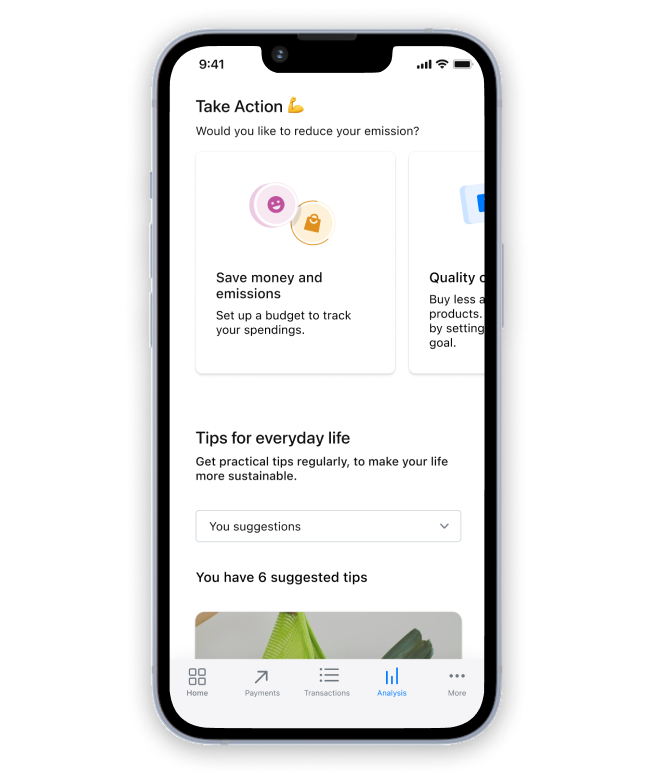

Tips & Gamification

With tips and gamification elements that are constantly being expanded, concrete recommendations for reducing your footprint are suggested that can be saved and directly implemented by your customers.

Increasing engagement

Thanks to the Carbon Footprint Manager, you increase engagement in digital banking, address sustainable target groups and stand out from other banks.

Understand

Personal CO₂ footprint based on transactions compared to the Swiss average.

Coach

Personalised tips with gamification elements to lowering CO₂ emissions.

Enable

Achieve sustainability goals with sustainable budgets and cross-sell to the bank’s sustainable products.

In everyday practice

Consumers want to act, shop, and live in a more sustainable manner. One particularly effective approach is for banks to support their customers in taking action against climate change themselves.

With the CO₂ Footprint Manager, you pick up your customers exactly where they are, namely in their private account that reflects their own consumption.

As a solid foundation

The CO₂ calculations are based on Swiss climate data. The calculated CO₂ results serve as a solid foundation for an effective assessment of one’s own CO₂ consumption.

The Swiss database allows users to see how their carbon footprint compares to the Swiss average. Positive feedback helps with the self-assessment and encourages users to reduce their personal emissions in the long term.

For additional products

The Carbon Footprint Manager enables customers to implement their sustainability goals in a concrete way and allows you to target customer interests with sustainable product suggestions, thus creating new cross-selling potential.

Analyse the carbon footprint of third-party banks

Third-party accounts at third-party banks can also be integrated, provided that the multibanking option is used by the respective bank.

The transactions are automatically divided into the carbon footprint categories Food, Home, Travel & Transport, Shopping, and Health & Leisure and are also aggregated via the third-party accounts.

Any questions?

Do you have any further questions about Contovista’s CO₂ footprint manager? Just drop us a line.

We will be happy to help with any questions you may have!

Andreas Lenke

Manager Strategic Projects at Thurgauer Kantonalbank

« With the personal financial assistant, we offer our customers great added value right from the start of the new portal and can, among other things, fulfil their wish for a clear and attractive presentation of their private finances. »

Bodo Grauer

Head Digital Strategy & Transformation at Avaloq

« Contovista is one of the stars in the Swiss fintech scene and we are very happy to have a lot of customers in common – and very satisfied ones. Their solution is a showcase for the existence of fintechs: innovative, value-add for clients, and ease and speed of implementation. The team has a good spirit, positive and forward looking mindset and I really enjoy working with them – Its fun and you always learn a lot. »

Christoph Wille

Head of Sales Channels and Member of the Executive Board at Valiant Bank AG

« With the Multibanking Service we are responding to the high demand from our business customers for a comprehensive overview of their accounts with Valiant and other banks. In combination with the BFM, we are offering an exclusive service in Switzerland, enabling SMEs to easily manage their finances and liquidity across banks. This represents a clear differentiating factor and strengthens our position as a modern SME bank. »

Dominik Gabler

Data Scientist at SZKB

« The solutions in analytics and machine learning make it possible to analyze and address individual customer needs and use the insights gained profitably. Contovista is an ideal partner and source of inspiration for Schwyzer Kantonalbank and regularly provides inspiration on how we can exploit untapped business potential in the digital world. »

Dr. Simon Alioth

Managing Director , Synpulse8

« Financial service providers support their customers with advice and assistance in achieving their financial goals. As a strong partner for personal finance management, Contovista offers a suitable, API-based solution for financial service providers. Through Contovista’s presence on the Synpulse8 OpenWealth Marketplace, financial service providers have the opportunity to develop tailor-made solutions for their clients to optimally meet their needs. »

Dr. Simon Youssef

Co-founder Neon

« As a young Fintech we were looking for a dynamic product and besides the clean API interface the fast and unbureaucratic cooperation with Contovista convinced us from the beginning. »

Fabian Marti

Head of Digital Solutions at Aargauischen Kantonalbank

« Digitization covers all areas of a company and is becoming increasingly important in the financial sector. With Contovista’s financial assistants, we therefore offer our private and business customers modern extensions to the AKB portal. The services were immediately received positively by our customers and make digital banking even more personal »

Mike Hofmann

Senior Product Manager for bLink at SIX

« With their leading BFM & PFM solutions, Contovista is adding a key element to bLink’s mission of establishing OpenAPI-based multibanking for both corporate and private customers among Swiss financial institutions. We highly value the team’s pragmatic and pioneering approach and we are convinced that it is such technical cooperations that lead to the creation of a synergetic Open Finance ecosystem benefiting the Swiss financial industry. »

Niclas Persson

CEO & Co-Founder – Deedster

« Contovista is the undisputed PFM market leader of Switzerland and we are very proud to partner with them as they make sustainability a core capablity in their next generation solutions for the financial markets. »

Oliver Dlugosch

CEO of NDGIT

« Contovista is a great addition to our API marketplace and we are very proud to have them as partners. Because only by always offering the best, most up-to-date and smartest applications for banks, fintechs and insurance companies, we keep our position as #1 provider in the open banking platform sector. »

Roland Zwyssig

Viseca Payment Services SA, Senior Advisor

« The cooperation with Contovista can help established financial institutions to introduce innovative services and functions faster. Viseca strives to play a pioneering role in the digitisation of credit cards and, together with partners from the Fintech sector, to create added value for both partner banks and credit card customers. »

Silvio Böhler

Head of Technology bei True Wealth

« With Contovista, bank customers with investment potential can be identified in a more targeted approach, and then receive a simple and effective investment strategy from us, in a fully automated manner. Especially in view of challenges the industry is facing as a result of digitalization, efficiency is a key factor in future market cultivation. »

Stefanie Feigt

CEO at 3rd eyes analytics

« We are very pleased to be partnering with Contovista. Their innovative products, which are quick and easy to implement, ideally complement our individual wealth planning solutions. The combination of our offerings provides tremendous added value for our clients and we are excited to jointly offer future-oriented services for the financial service industry. »