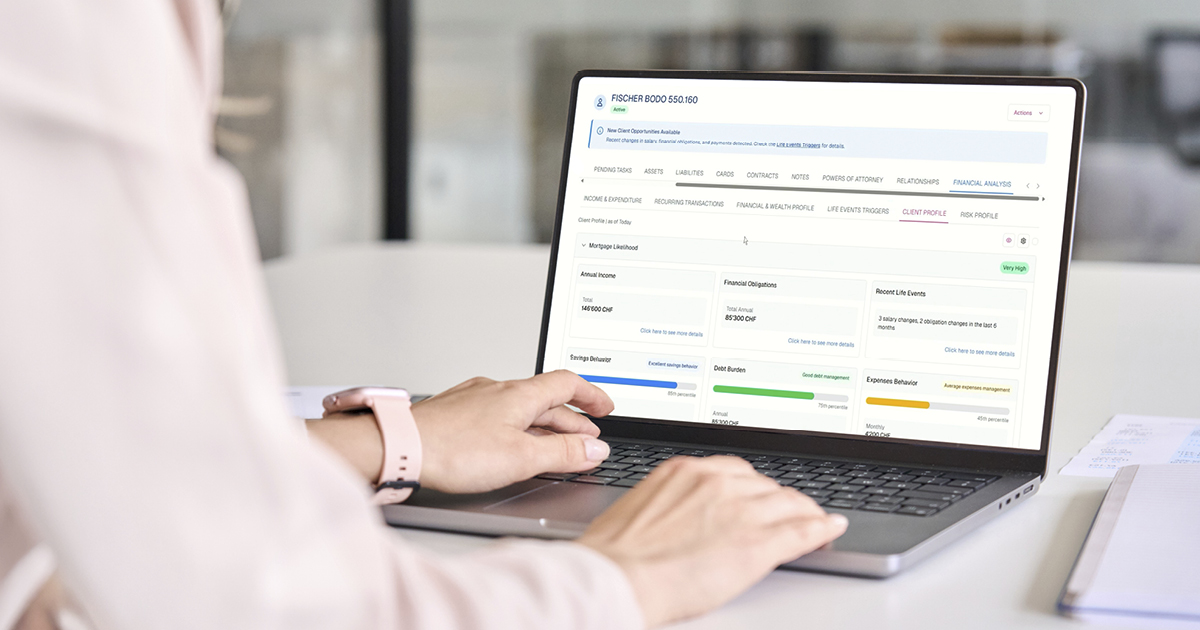

From a technological perspective, Contovista’s approach combines two layers. The first layer consists of robust, specialised systems for categorising transaction data and analysing it using traditional machine learning (ML). To this end, we have developed our Enrichment Engine for data categorisation and our Client Analytics for analysis. This approach is economical, efficient and highly precise, while remaining strongly customer-centric: the analyses deliver actionable insights into financial situations (such as salary trends, new financial obligations, churn signals, property financing, or risk profiles).

On the second layer, we use GenAI to operationalise these insights. With lean, efficient LLMs, we build productive workflows around transaction data: efficient interfaces, automations and decision support, for example for customer advisory processes or cross-selling.

Superior ROI – With AI Solutions from Contovista

Contovista’s solutions therefore combine domain-specific, ML-based analytics with the benefits of GenAI. The strategic principle is clear: differentiation instead of boundless scaling and the associated costs – or, put differently, scaling only where it makes sense. For financial institutions, this provides a powerful transformation lever whose ROI is likely, in many cases, to exceed that of the costly mega-initiatives pursued by the largest players.

Would you like to learn more about how Swiss banks can navigate the risks of AI hype with the right strategy and implement a focused transformation? Then simply get in touch with our experts.