Smart Balance Optimizer

This summer’s innovation: The Smart Balance Optimizer for intelligent cash management

This summer’s innovation: The Smart Balance Optimizer for intelligent cash management

Self-Driving Money for Digital Banking

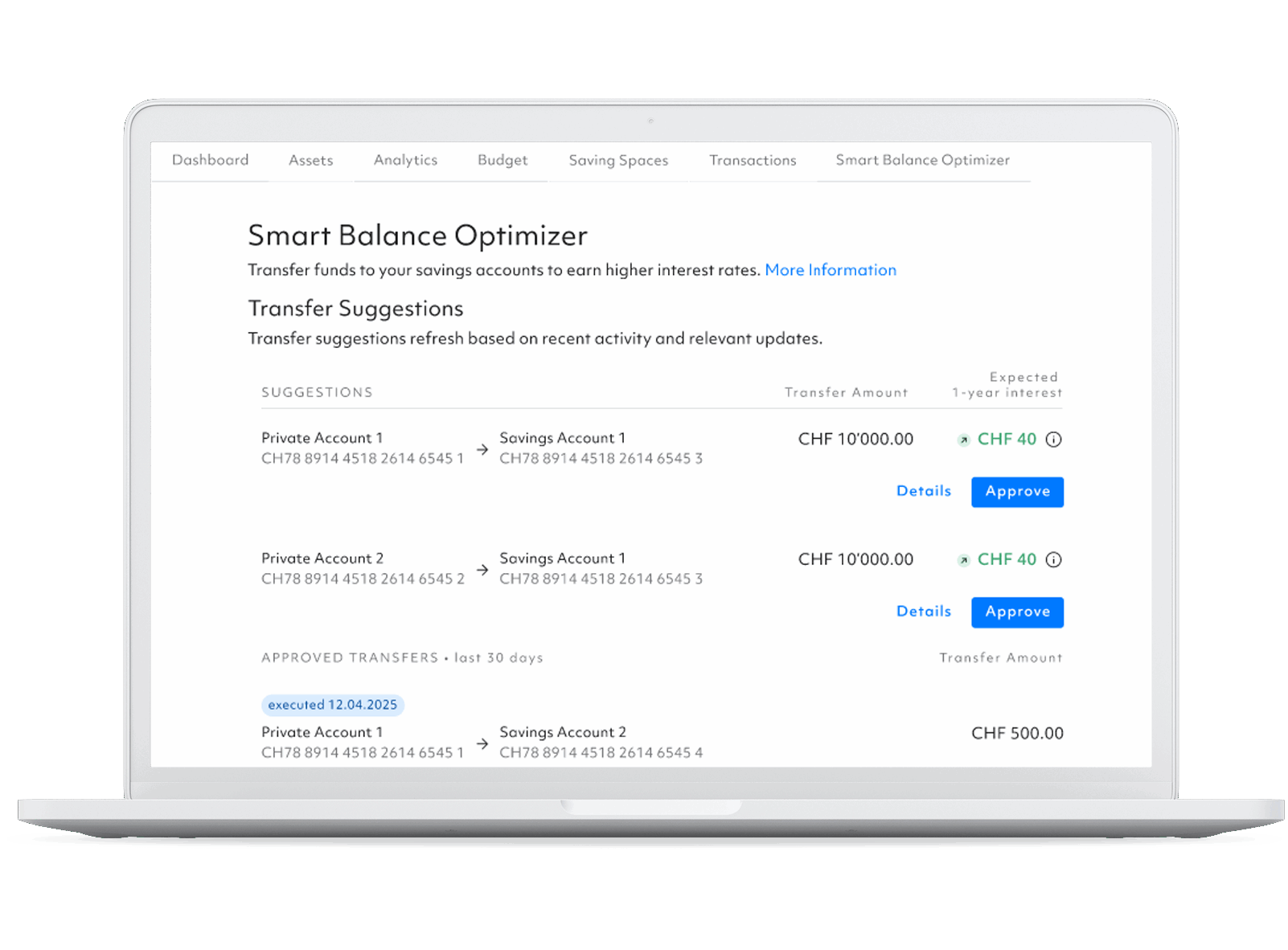

What if available funds in a bank account could almost automatically be allocated in the best possible way? The Smart Balance Optimizer by Contovista makes exactly that possible!

The solution is powered by explainable agentic AI. It recognizes individual financial patterns in real time, calculates future liquidity needs, and provides well-founded transfer recommendations—directly within digital banking and executable with a single click. This creates a new kind of user experience that combines control, transparency, and real financial benefits.

Financial institutions that want to go beyond digitisation and create real added value rely on intelligent automation with substance. The Smart Balance Optimizer is a concrete step toward Self-Driving Money —explainable, data-driven, and seamlessly integrable.

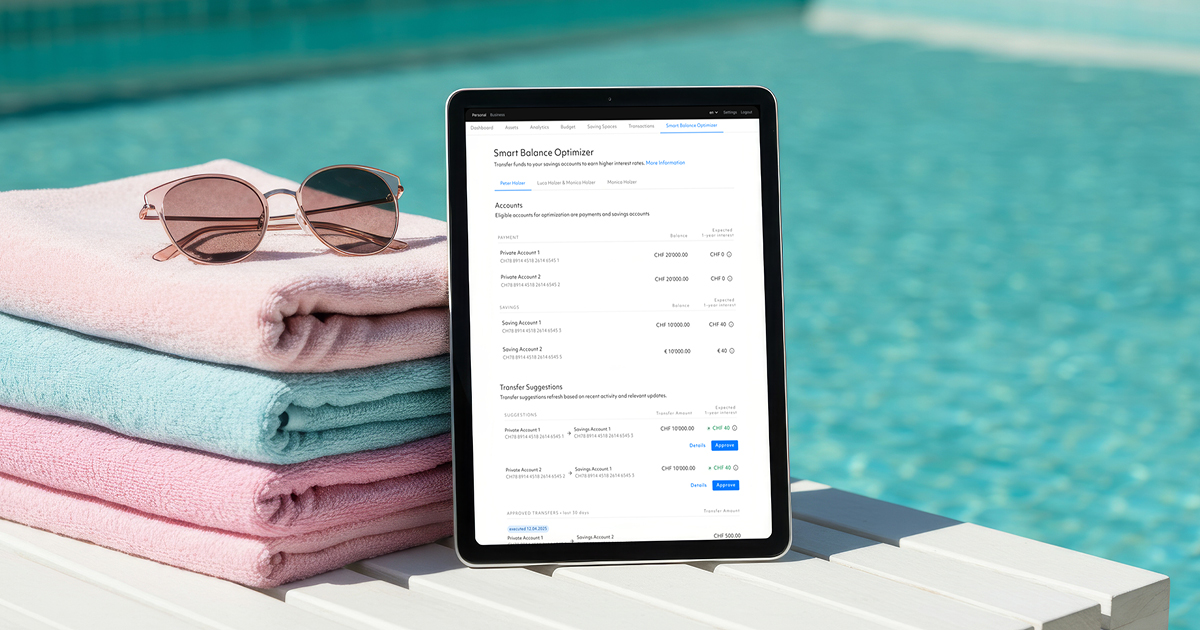

Illustration: The Smart Balance Optimizer by Contovista

Time for a Paradigm Shift

Financial well-being is more important than ever. Users want more control—and they want their savings to work for them. Yet many banking customers still leave valuable return potential untapped.

A survey conducted by Contovista showed that 85% of digital banking users miss out on an average of CHF 160 in return potential per year. The Smart Balance Optimizer unlocks this potential—automatically, at scale, and with greater gains for the users.

Now is the time to rethink digital services—personalised, automated, and ready for the next generation of digital banking.

How Banks and Customers Benefit

Whether it’s savings, salary, or reserve accounts—the Smart Balance Optimizer ensures that money works where it makes the most sense. Automatically, transparently, and always under the user’s control.

Benefits for customers:

- Higher returns: No more lost yield on salary accounts

- Clear overview: Recommendations are transparent—decisions remain in the hands of the user

- Reliable availability: Forecasts and smart buffers help detect and prevent shortfalls in advance

Banks benefit as well:

- Increased revenue: Higher deposits improve the credit base while opening new revenue streams through targeted placement of investment and financing products

- Cost savings: Automated processes reduce payment transaction inquiries and noticeably lower operational support costs

- Higher customer satisfaction: Relevant recommendations, smart experiences, and simple alternatives to traditional offerings like cash pooling strengthen relationships with both retail and SME customers

The Smart Balance Optimizer is available as part of our AI Personal Finance Manager and AI Business Finance Manager, or as a standalone solution.