Summer Release 2025

Smart Balance Optimizer, natural language search, subscription features for SMEs and the enhancement of the Carbon Footprint Manager and many more.

Smart Balance Optimizer, natural language search, subscription features for SMEs and the enhancement of the Carbon Footprint Manager and many more.

Banking that Thinks Ahead: Why the Summer Release 2025 Changes Everything

Our latest release once again focuses on intelligent automation and enhanced user experience. Our AI solutions continue to evolve — with true product innovation. See for yourself:

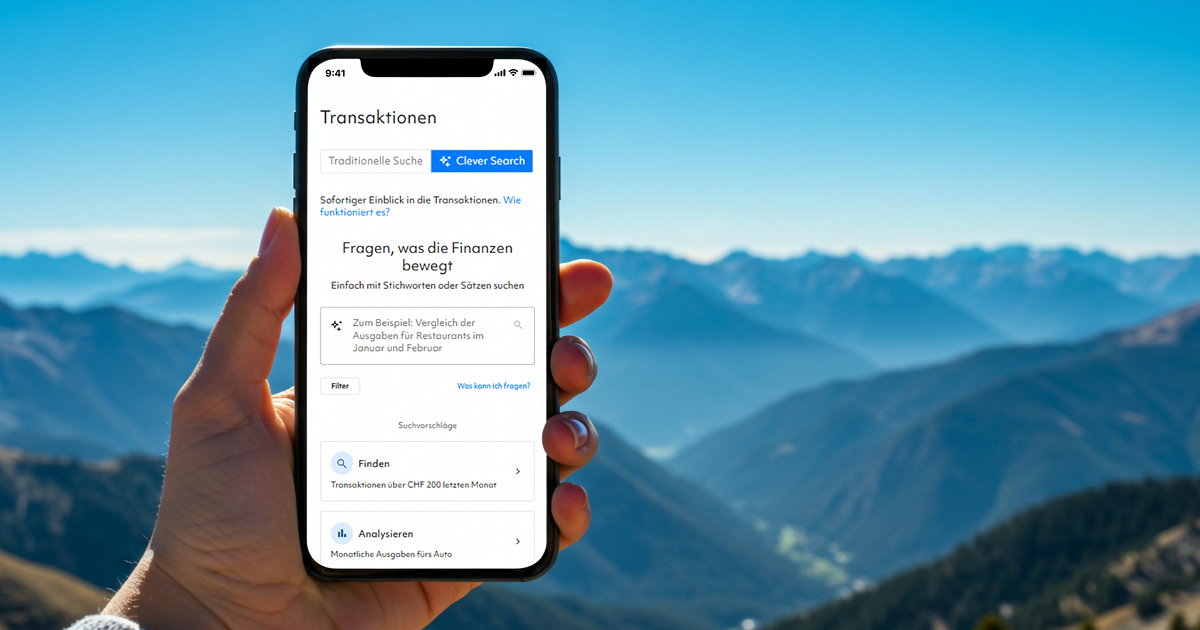

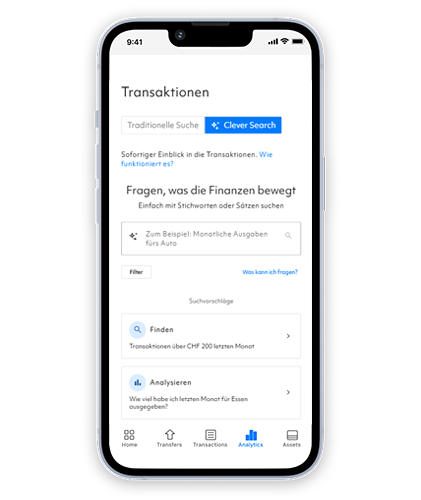

Smarter Search with Natural Language Search

With our new natural language search, we’re making the banking experience more intuitive than ever before — giving your customers an entirely new way to interact with digital banking.

Integrated into our AI Finance Managers (PFM, BFM), the search function analyses underlying transaction data in real time using AI. Your customers can ask their questions directly in plain language — no technical terms or manual filters needed.

- Retail example:“How much did I spend on my vacation in Spain?”

- SME example: “How much did we spend on Social Media in 2024.”

They instantly receive clear, precise, and context-based answers. This brings complex financial data into context — directly within digital banking, compliant with data protection, and accessible to all users. It enhances usability, satisfaction, and your customers’ financial literacy.

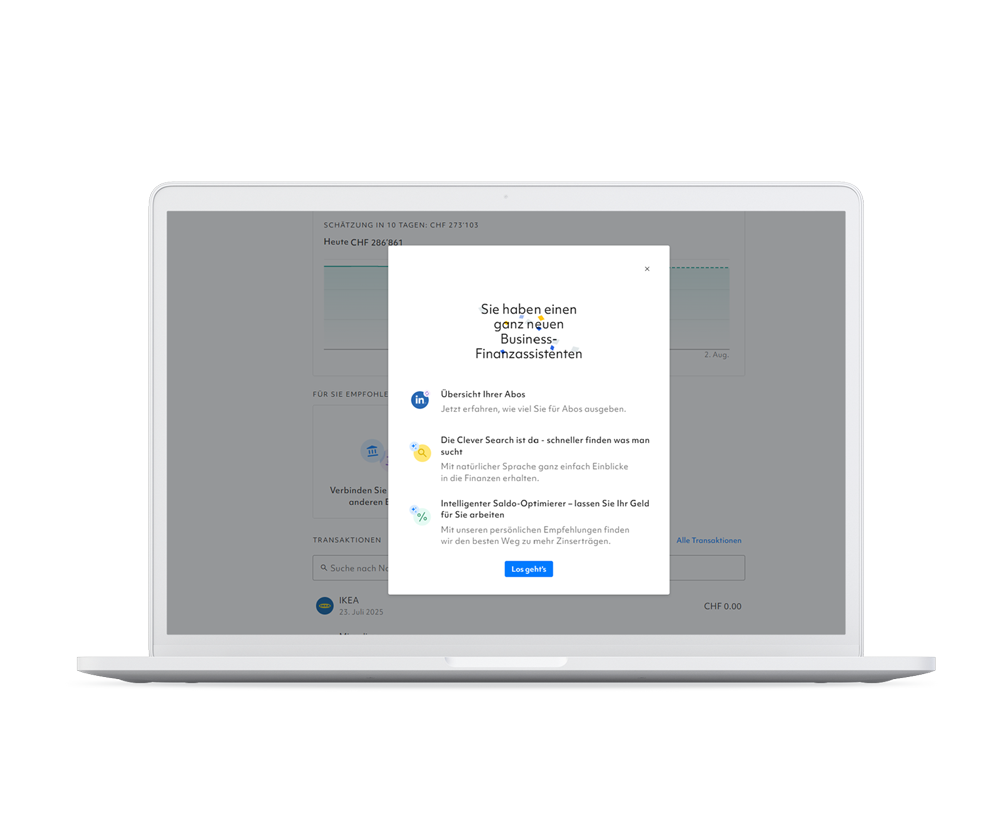

New: Subscription Overview in the AI Business Finance Manager

We’ve now integrated the Subscription Overview into the AI Business Finance Manager. This means that SMEs can also benefit from our popular feature, with automatic categorisation and detection of ongoing subscriptions.

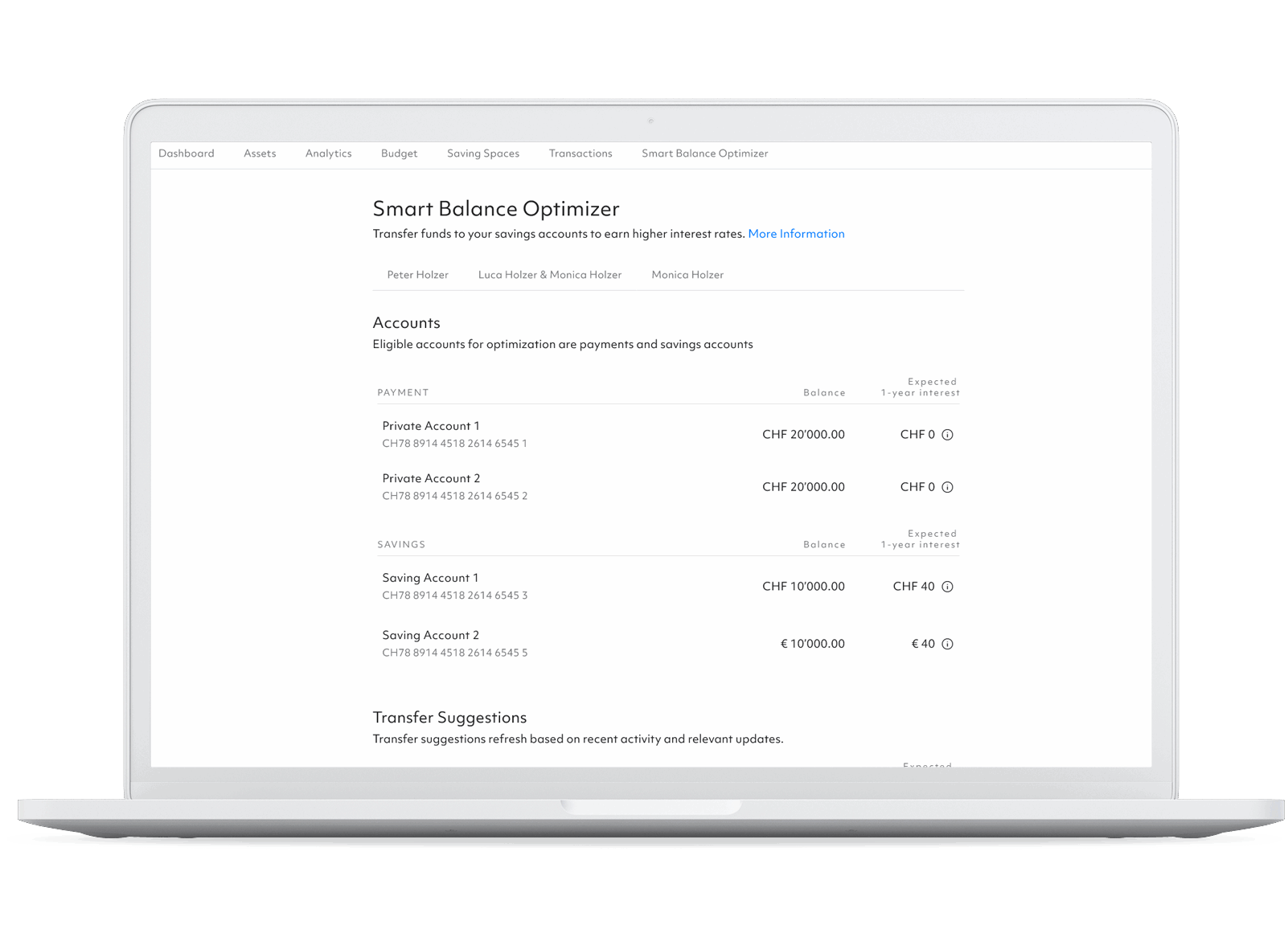

Smart Balance Optimizer

A milestone on the path to banking that thinks ahead and a major step toward Self-Driving Money:

The Smart Balance Optimizer is the AI-powered assistant for intelligent liquidity and interest rate management. It automatically analyses your customers’ financial behaviour, identifies their spending patterns, and suggests actions to help them earn more interest — without manual effort.

Users benefit from higher interest earnings and full control — all on autopilot. For SMEs, the Smart Balance Optimizer also offers a smart alternative to traditional cash pooling solutions, which are primarily geared toward large corporations.

The Smart Balance Optimizer is available as part of our AI Personal Finance Manager and AI Business Finance Manager — or as a stand alone solution.

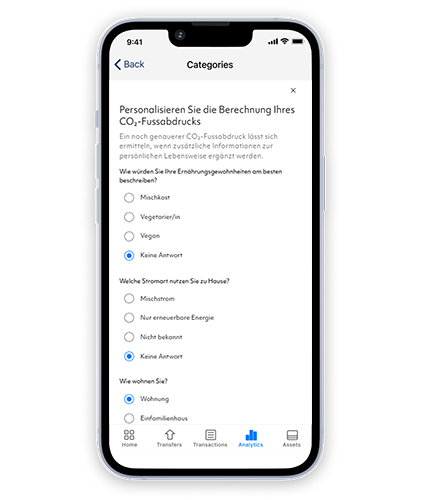

Update: Carbon Footprint Manager

The newly integrated questionnaire in the Carbon Footprint Manager lays the foundation for even more accurate CO₂ calculations.

Now, individual factors such as housing type, heating method, and diet are included in the analysis. Users gain more accurate insights into their personal carbon footprint — directly in digital banking.

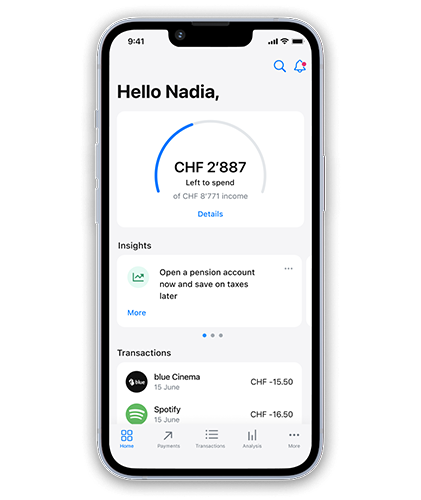

Update: Left-to-Spend in the AI Finance Manager

The start date can now be freely selected — for example, the day the salary is received. This allows the tool to better align with the users personal cash flow.

Large expenses such as bills or one-time purchases are automatically highlighted. Users immediately see why their available budget has changed — providing more control and preventing unpleasant surprises.