Multibanking

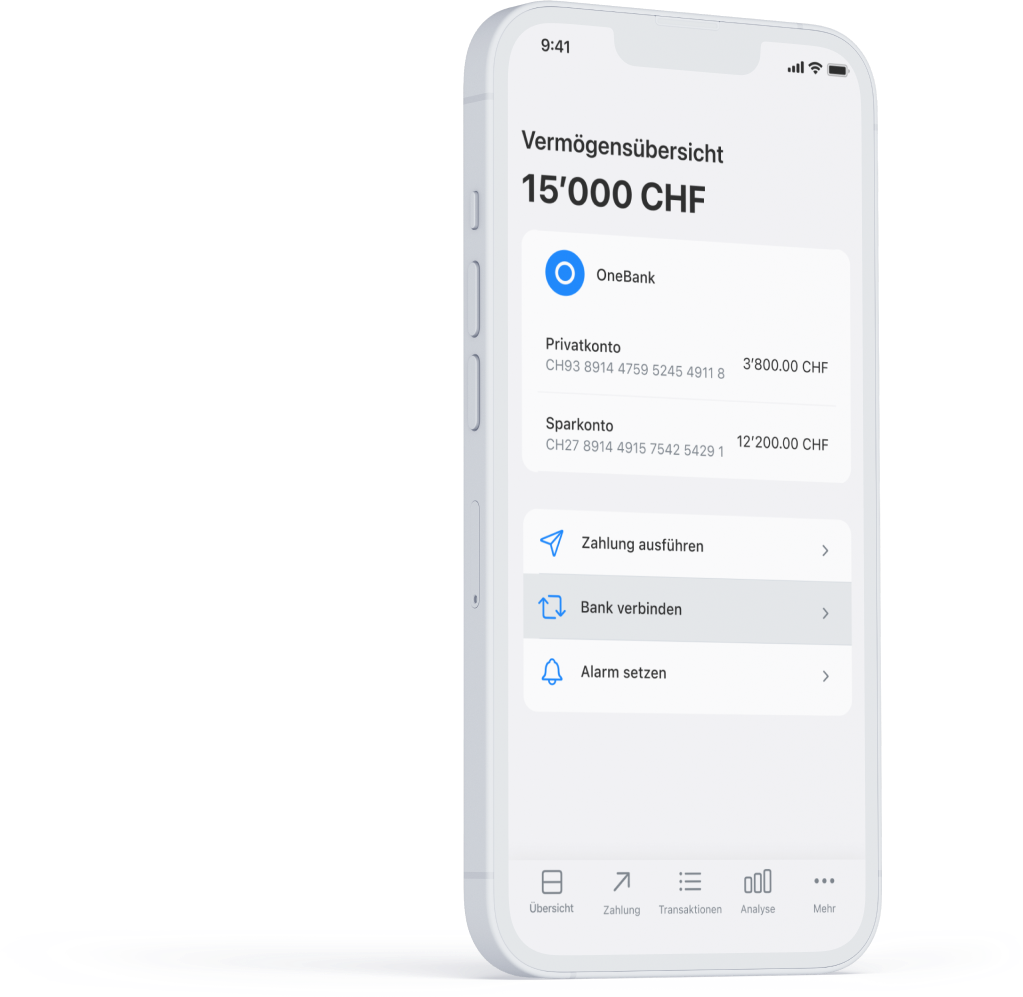

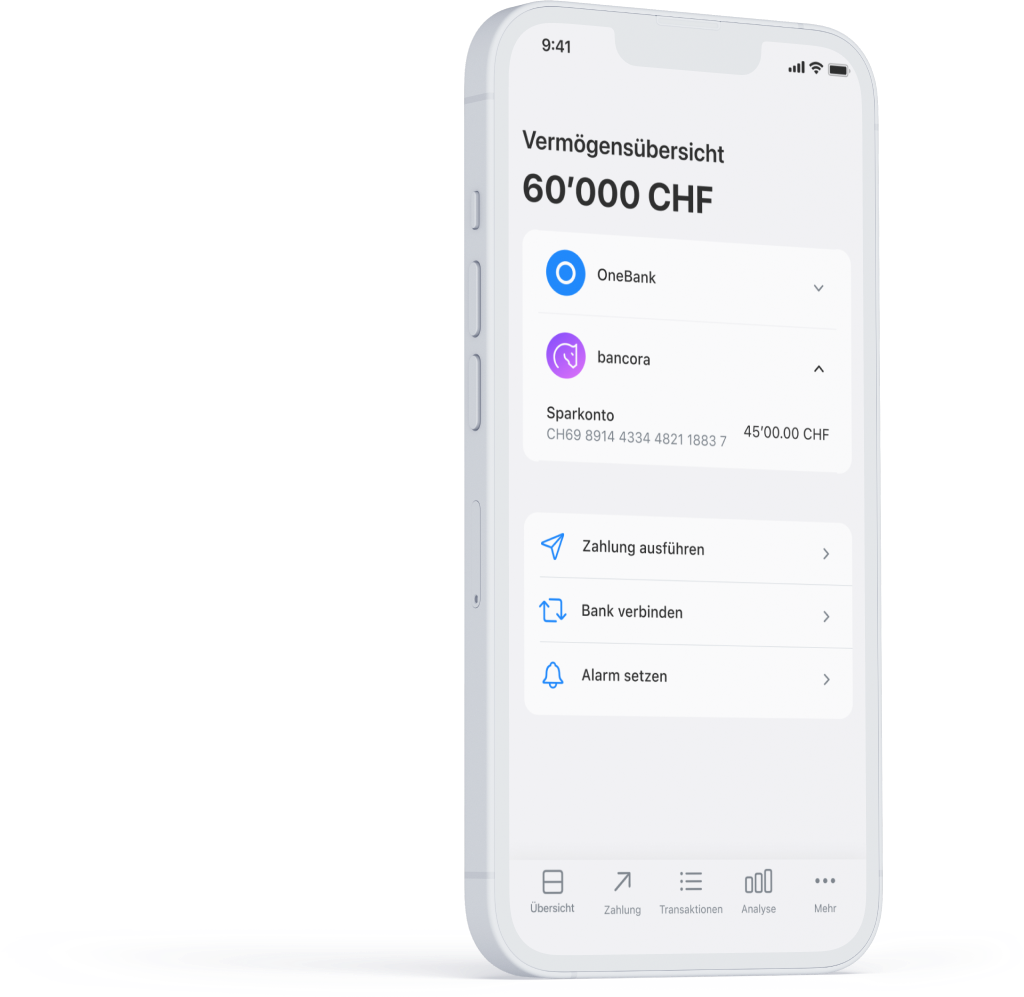

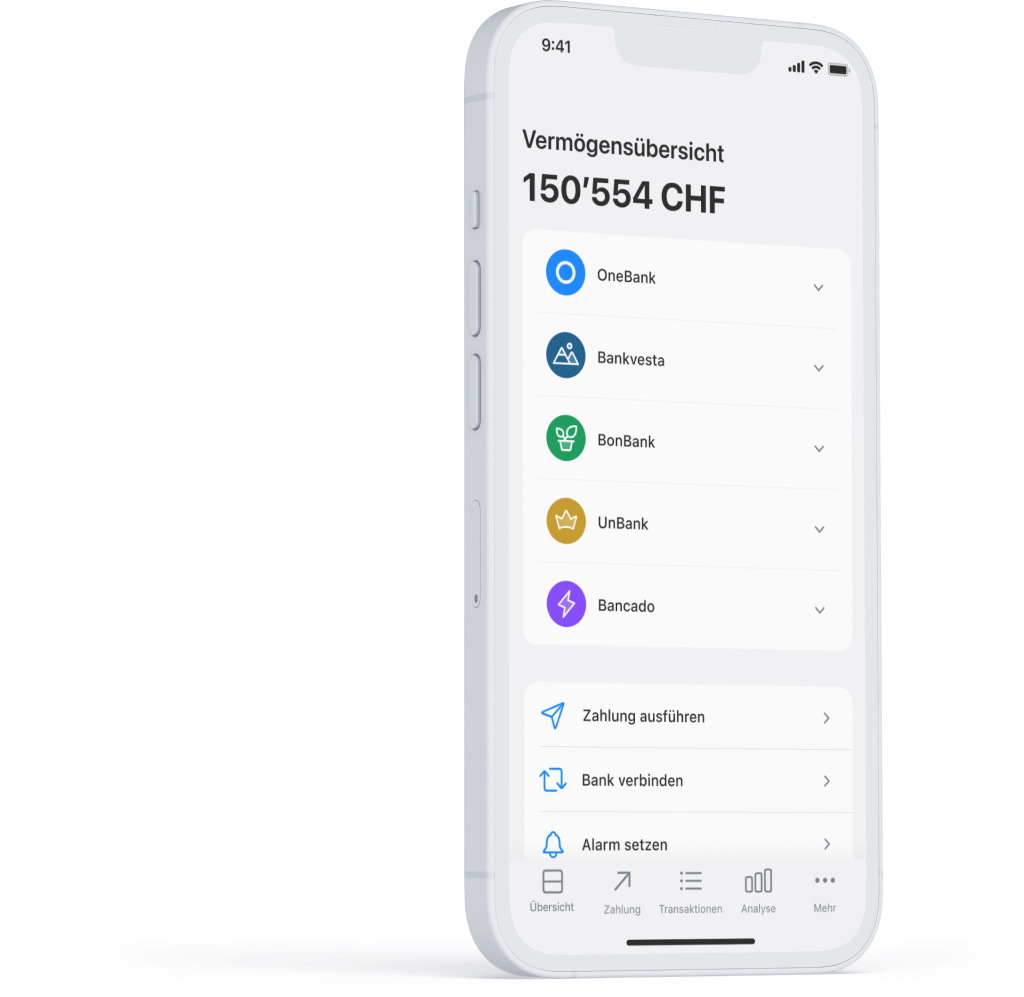

Multibanking for retail customers allows you to manage bank accounts from different institutions in one central location. This is what having a holistic view of your finances looks like.

Multibanking for retail customers allows you to manage bank accounts from different institutions in one central location.

Contact our experts

Multibanking for retail customers

Contovista’s multibanking solution seamlessly integrates with any digital banking system, independent of the core banking system. As a “service user”, Contovista can already offer full multibanking capabilities with platforms such as bLink.

With automated account aggregation in multibanking, your customers can reap the benefits of automated balance reconciliation and a real-time consolidated overview of their finances. They can access all their accounts from different banks in one digital banking environment with a single login. This streamlined approach simplifies the management of multiple accounts, enhances transparency, and offers greater convenience for users.

Full overview thanks to multibanking

Effortless bank integration

Your customers can seamlessly add new banks to their digital banking account with just a few clicks.

Comprehensive financial overview

Get an instant financial overview thanks to automated account aggregation of all linked accounts.

Simplified access with one login

Automatic categorisation of connected accounts, including transaction data enrichment with merchant logos and “pretty names”

Multibanking with Contovista

Set the course for the future today

In spring 2023, the Swiss Bankers Association (SBA) and approximately 20 banks signed a Memorandum of Understanding to facilitate the introduction of the first multibanking services for individual customers by mid-2025. The goal is to enhance interoperability and data exchange among banks, FinTechs, and other financial institutions.

Alongside the core multibanking functions, the Personal Finance Manager (PFM) offers your customers a range of additional benefits. For instance, transactions from external banks are automatically categorised, enriched, and can be analysed across all linked institutions.

This enhancement in the informative value of the analytics provides significant advantages for users. As a bank, it translates into increased engagement and potential as well as targeted & personalised cross- and upselling opportunities.

By leveraging the full suite of PFM functions, your customers can actively enhance their financial situation. With multibanking and PFM, your institution becomes an even more vital interface and the primary financial touchpoint for your customers.

Still got questions?

If you have any further questions regarding Contovista’s multibanking offering for retail and business customers, or if you would like more information about the Memorandum of Understanding, please don’t hesitate to reach out to us.

Get in touch

Andreas Lenke

Manager Strategic Projects at Thurgauer Kantonalbank

« With the personal financial assistant, we offer our customers great added value right from the start of the new portal and can, among other things, fulfil their wish for a clear and attractive presentation of their private finances. »

Bodo Grauer

Head Digital Strategy & Transformation at Avaloq

« Contovista is one of the stars in the Swiss fintech scene and we are very happy to have a lot of customers in common – and very satisfied ones. Their solution is a showcase for the existence of fintechs: innovative, value-add for clients, and ease and speed of implementation. The team has a good spirit, positive and forward looking mindset and I really enjoy working with them – Its fun and you always learn a lot. »

Christoph Wille

Head of Sales Channels and Member of the Executive Board at Valiant Bank AG

« With the Multibanking Service we are responding to the high demand from our business customers for a comprehensive overview of their accounts with Valiant and other banks. In combination with the BFM, we are offering an exclusive service in Switzerland, enabling SMEs to easily manage their finances and liquidity across banks. This represents a clear differentiating factor and strengthens our position as a modern SME bank. »

Dominik Gabler

Data Scientist at SZKB

« The solutions in analytics and machine learning make it possible to analyze and address individual customer needs and use the insights gained profitably. Contovista is an ideal partner and source of inspiration for Schwyzer Kantonalbank and regularly provides inspiration on how we can exploit untapped business potential in the digital world. »

Dr. Simon Alioth

Managing Director , Synpulse8

« Financial service providers support their customers with advice and assistance in achieving their financial goals. As a strong partner for personal finance management, Contovista offers a suitable, API-based solution for financial service providers. Through Contovista’s presence on the Synpulse8 OpenWealth Marketplace, financial service providers have the opportunity to develop tailor-made solutions for their clients to optimally meet their needs. »

Dr. Simon Youssef

Co-founder Neon

« As a young Fintech we were looking for a dynamic product and besides the clean API interface the fast and unbureaucratic cooperation with Contovista convinced us from the beginning. »

Fabian Marti

Head of Digital Solutions at Aargauischen Kantonalbank

« Digitization covers all areas of a company and is becoming increasingly important in the financial sector. With Contovista’s financial assistants, we therefore offer our private and business customers modern extensions to the AKB portal. The services were immediately received positively by our customers and make digital banking even more personal »

Mike Hofmann

Senior Product Manager for bLink at SIX

« With their leading BFM & PFM solutions, Contovista is adding a key element to bLink’s mission of establishing OpenAPI-based multibanking for both corporate and private customers among Swiss financial institutions. We highly value the team’s pragmatic and pioneering approach and we are convinced that it is such technical cooperations that lead to the creation of a synergetic Open Finance ecosystem benefiting the Swiss financial industry. »

Niclas Persson

CEO & Co-Founder – Deedster

« Contovista is the undisputed PFM market leader of Switzerland and we are very proud to partner with them as they make sustainability a core capablity in their next generation solutions for the financial markets. »

Oliver Dlugosch

CEO of NDGIT

« Contovista is a great addition to our API marketplace and we are very proud to have them as partners. Because only by always offering the best, most up-to-date and smartest applications for banks, fintechs and insurance companies, we keep our position as #1 provider in the open banking platform sector. »

Roland Zwyssig

Viseca Payment Services SA, Senior Advisor

« The cooperation with Contovista can help established financial institutions to introduce innovative services and functions faster. Viseca strives to play a pioneering role in the digitisation of credit cards and, together with partners from the Fintech sector, to create added value for both partner banks and credit card customers. »

Silvio Böhler

Head of Technology bei True Wealth

« With Contovista, bank customers with investment potential can be identified in a more targeted approach, and then receive a simple and effective investment strategy from us, in a fully automated manner. Especially in view of challenges the industry is facing as a result of digitalization, efficiency is a key factor in future market cultivation. »

Stefanie Feigt

CEO at 3rd eyes analytics

« We are very pleased to be partnering with Contovista. Their innovative products, which are quick and easy to implement, ideally complement our individual wealth planning solutions. The combination of our offerings provides tremendous added value for our clients and we are excited to jointly offer future-oriented services for the financial service industry. »