Smart Balance Optimiser

The agentic AI-powered balance and interest optimiser for digital banking – for both retail and business customers.

The agentic AI-powered balance and interest optimiser for digital banking – for both retail and business customers.

Contact our experts

The smart solution for smart digital banking

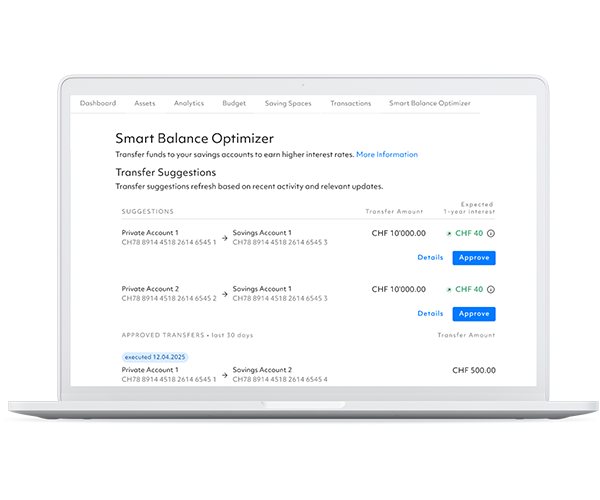

The Smart Balance Optimiser uses explainable AI to maximize returns by optimizing liquidity across accounts– while ensuring funds are available when needed.

It continuously detects real-time financial patterns, forecasts liquidity requirements, and proactively recommends fund movements between accounts.

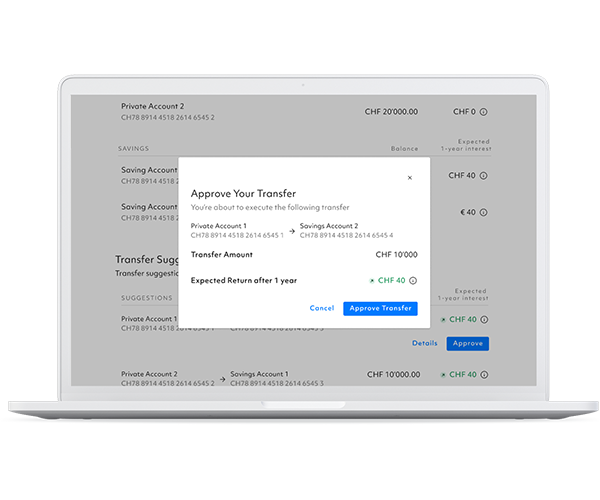

Customers can effortlessly approve these suggestions directly within their digital banking environment—seamlessly integrated. They gain greater control, peace of mind, and tangible financial gains.

For financial institutions, new revenue opportunities and efficiency gains can be achieved, while stickier deposits mean enhanced margins, reduced funding and capital costs. It strengthens customer retention through relevant, intelligent digital experiences—positioning banks at the forefront of digital innovation.

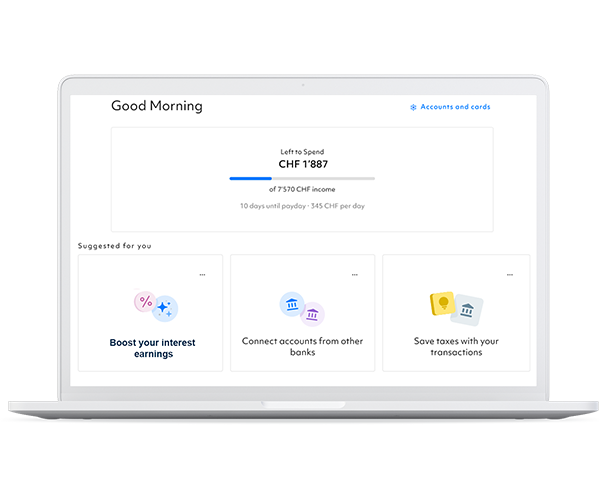

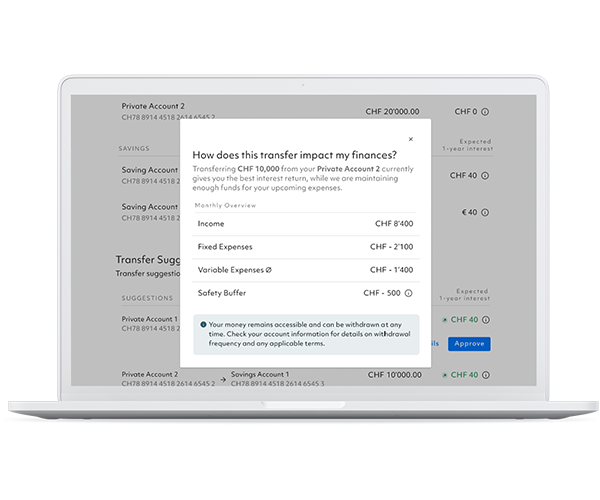

Illustration: The Smart Balance Optimiser by Contovista

Beyond automation: Toward self-driving money

This is more than a smart assistant. The Smart Balance Optimiser marks a foundational shift toward self-driving money—enabling users to delegate trusted financial decisions. For banks, it signals the beginning of the agentic era: where financial systems evolve into intelligent platforms that interact with agents across individuals, institutions, and ecosystems.

The Smart Balance Optimiser at a glance

Simple intuitive Widget

Designed to be lean and engaging, the Smart Balance Optimizer transforms financial decisions into a smooth user experience—via intuitive widgets, clear flows, satisfying confirmations, and helpful contextual guidance.

Real-time intelligence

Analyses the financial picture across all accounts and banking relationships – including the transaction history, income and spending patterns, liquidity forecasts, and interest rates.

Full control

Customers see all details clearly and transparently, understand the forecasted return, and can edit, set rules, and ultimately approve the proposal.

Smart liquidity planning

Precise analytics, smart forecasts, and personalized safety buffers ensure customers always have enough liquidity for upcoming expenses.

Easy Integration – Flexible Delivery

The Smart Balance Optimiser is available as an add-on module for AI Personal Finance Manager and BFM, or as a standalone solution. Delivered via web or mobile component or API – seamlessly integrated into any system landscape – ISO-compliant, scalable and cloud-ready.

Unlocking hidden value:

85% of digital-banking users are not fully utilizing their potential, leaving on average CHF 160* per year untouched.

Banks can transform this dormant value into new revenue streams through a high-margin fee model, increased deposits, and unlocked capital for lending or low-risk investments.

*Source: Contovista inhouse data analysis

Save and fully automated

The Smart Balance Optimiser ensures the right buffer is always in place to avoid overdrafts and missed payments.

For banks, this means more stable deposits, better LCR ratios, and reduced need for emergency funding.

Drive simplicity with guided automation

No more manual transfers, Excel sheets or mental math – users get clear, smart suggestions in just a few clicks.

Banks benefit from reduced support inquiries and lower operational costs.

Boosting relevance

More than 50% of users view financial well-being as a top priority. The Smart Balance Optimiser becomes a daily digital companion – analyzing spending, encouraging savings, and promoting better money habits.

The result: increased relevance, deeper long-term trust and retention for Banks.

At the core of smart banking

The Smart Balance Optimser delivers a next-gen experience that users love – analyzing behavior, offering actionable advice, and helping users to be in control.

It strengthens the digital positioning of financial institutions, accelerates acquisition, and opens up cross-selling opportunities – from cards and investments to additional services.

Ready to build self-driving liquidity into your digital banking stack?

Let’s explore how the Smart Balance Optimiser fits your portfolio – book your individual live demo today.

Contact us

Andreas Lenke

Manager Strategic Projects at Thurgauer Kantonalbank

« With the personal financial assistant, we offer our customers great added value right from the start of the new portal and can, among other things, fulfil their wish for a clear and attractive presentation of their private finances. »

Christoph Wille

Head of Sales Channels and Member of the Executive Board at Valiant Bank AG

« With the Multibanking Service we are responding to the high demand from our business customers for a comprehensive overview of their accounts with Valiant and other banks. In combination with the BFM, we are offering an exclusive service in Switzerland, enabling SMEs to easily manage their finances and liquidity across banks. This represents a clear differentiating factor and strengthens our position as a modern SME bank. »

Dominik Gabler

Data Scientist at SZKB

« The solutions in analytics and machine learning make it possible to analyze and address individual customer needs and use the insights gained profitably. Contovista is an ideal partner and source of inspiration for Schwyzer Kantonalbank and regularly provides inspiration on how we can exploit untapped business potential in the digital world. »

Dr. Simon Youssef

Co-founder Neon

« As a young Fintech we were looking for a dynamic product and besides the clean API interface the fast and unbureaucratic cooperation with Contovista convinced us from the beginning. »

Fabian Marti

Head of Digital Solutions at Aargauischen Kantonalbank

« Digitization covers all areas of a company and is becoming increasingly important in the financial sector. With Contovista's financial assistants, we therefore offer our private and business customers modern extensions to the AKB portal. The services were immediately received positively by our customers and make digital banking even more personal »

Roland Zwyssig

Viseca Payment Services SA, Senior Advisor

« The cooperation with Contovista can help established financial institutions to introduce innovative services and functions faster. Viseca strives to play a pioneering role in the digitisation of credit cards and, together with partners from the Fintech sector, to create added value for both partner banks and credit card customers. »