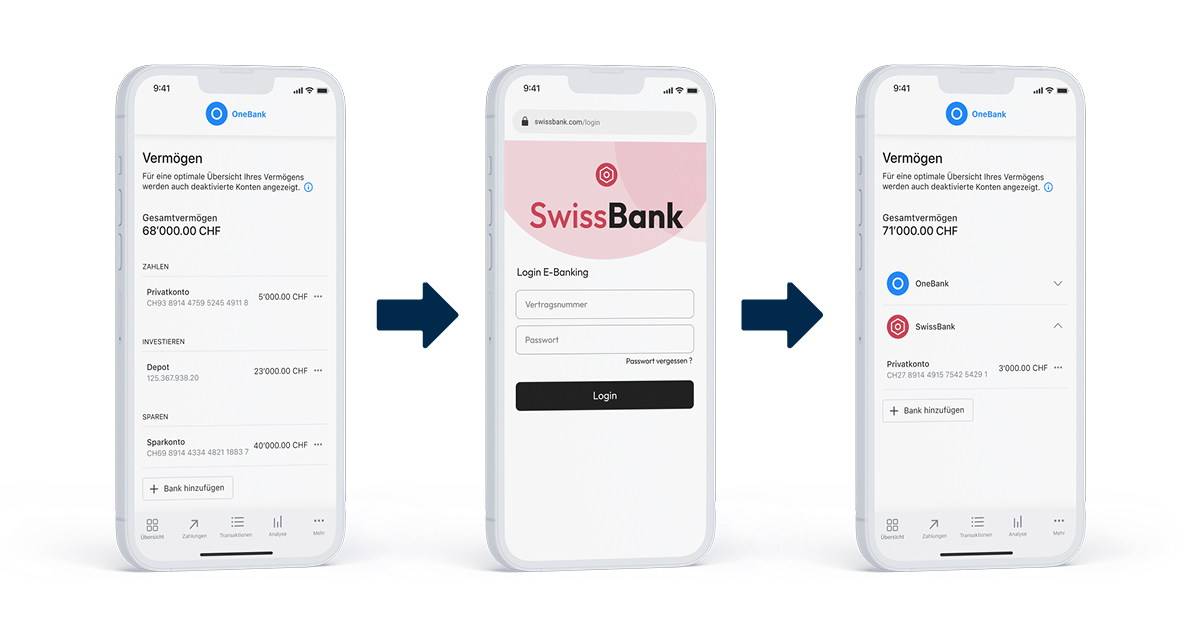

The Swiss Bankers Association regards multibanking as a particularly profitable use case of Open Finance, where “everyone benefits as a result”. The advantages are clear for consumers, as they can now get an up-to-date and complete picture of their entire finances on their familiar e-banking platform. This is an offering that is likely to be relevant for the majority of end users. According to a study conducted by the Lucerne University of Applied Sciences and Arts, Swiss people had an average of 2.2 banking relationships in 2020. Just a quarter of the respondents had only one private account.

It goes without saying that there’s a great deal of potential in this area. Yet the competition is not sleeping. Banks must act now when it comes to multibanking, otherwise dissatisfied customers will be tempted to migrate to their competitors, e.g., the many neo-banks and challenger banks that have emerged in Switzerland. Against this backdrop, multibanking in the retail sector provides established institutions with excellent leverage to remain or even become customers’ principal bank again – as the go-to platform for all financial transactions. At the same time, institutions can help stabilise their profit margins by retaining customers and utilising new, data-driven offerings to realise additional growth potential.

You can find data, facts, and a guide to successful multibanking here