Wir machen Banking relevant

Mit unseren AI Finance Management- und Data Analytics-Lösung erschliessen wir das Potenzial von Transaktionsdaten und helfen Finanzdienstleistern einzigartigen Kundennutzen zu stiften.

Mit unseren AI Finance Management- und Data Analytics-Lösung erschliessen wir das Potenzial von Transaktionsdaten und helfen Finanzdienstleistern einzigartigen Kundennutzen zu stiften.

Smart Balance Optimiser

Multibanking für Retail

Personalisierte Produktempfehlungen

Carbon Footprint Manager

Multibanking für KMUs

Data-driven Banking bringt mehr

%

Steigerung der Abschlussrate bei Privatkredit-Kampagne.

x

Höhere durchschnittliche Investitionssumme in Wertpapiere.

x

Steigerung der Abschlussrate im Kreditkartenvertrieb.

Unsere Finance Management- und Data Analytics-Lösungen

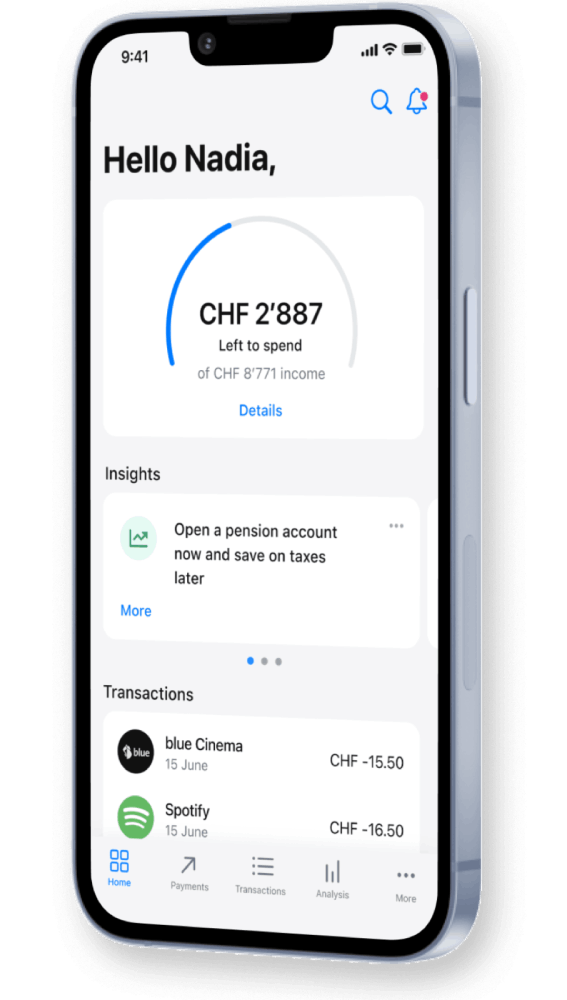

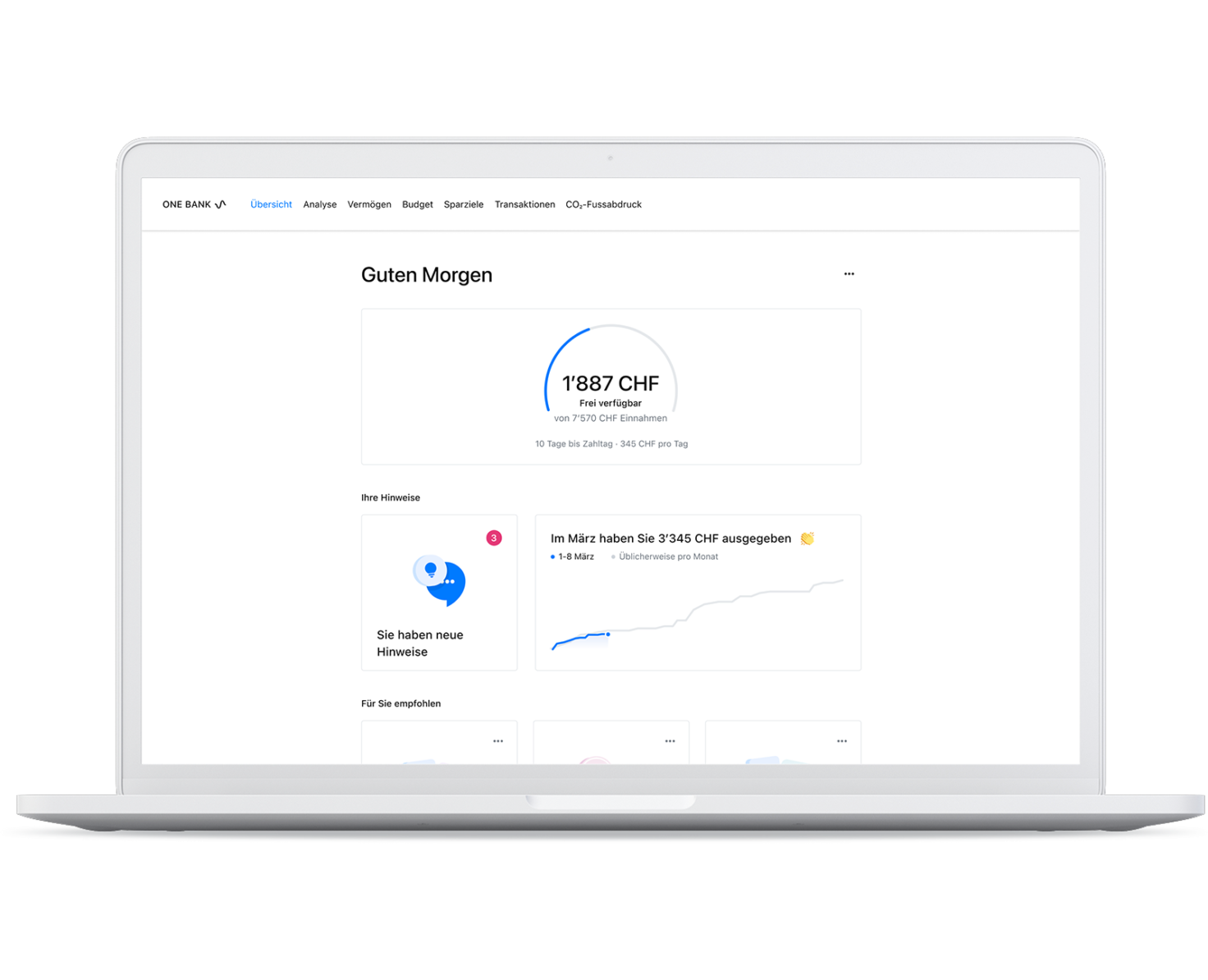

AI Personal Finance Manager

Der multibankfähige digitale Finanzassistent lässt sich einfach und nahtlos via API in jede Digital-Banking-Lösung integrieren. Dank AI und umfassender Branchenerfahrung erhalten Kund:innen hilfreiche Insights und Tipps zur besseren Kontrolle ihrer Finanzen. Finanzdienstleister profitieren dank umfassender Client Analytics Funktionen von wertvollen Kunden-Insights.

Weiterlesen

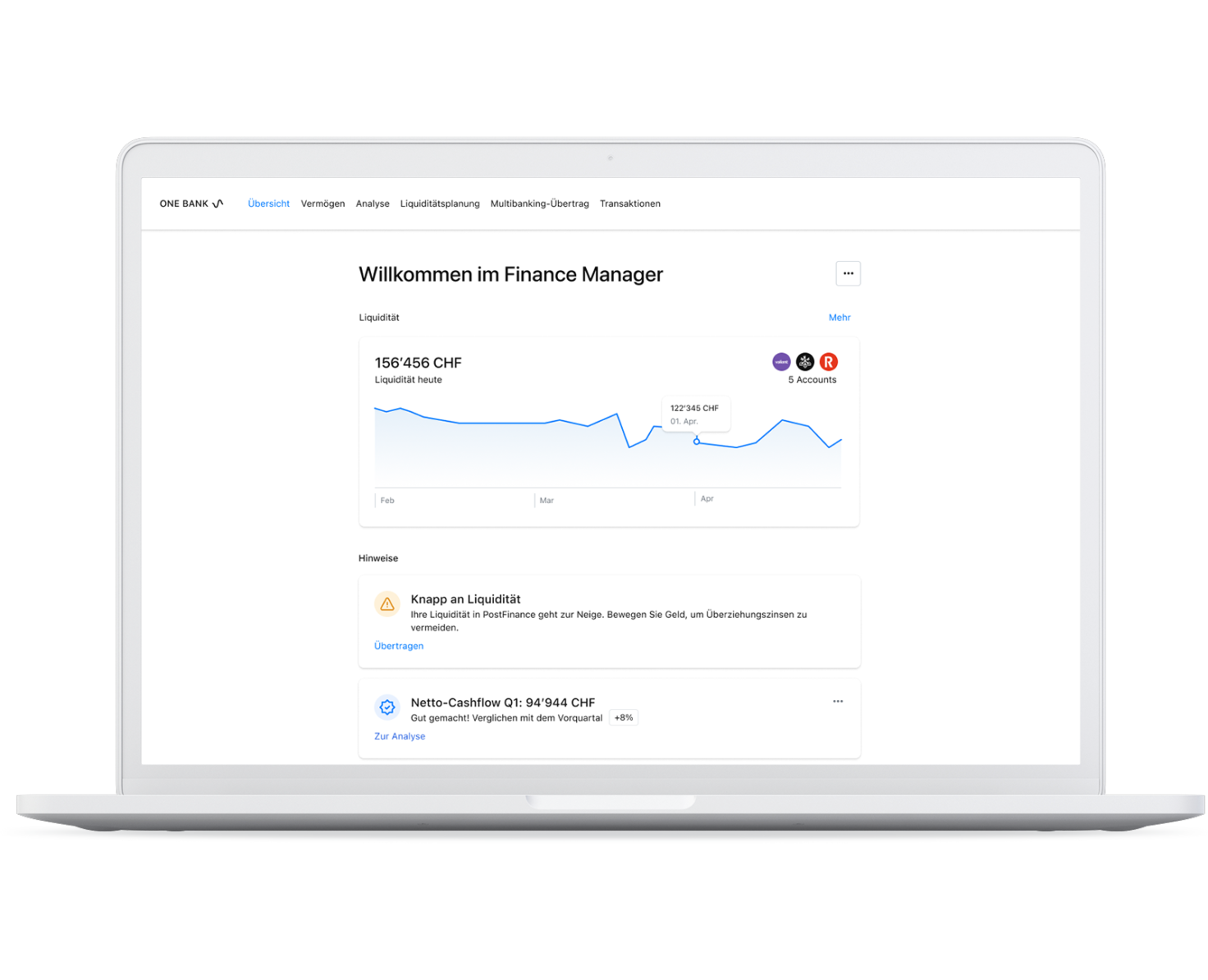

AI Business Finance Manager

Das AI gestützte 360°-Finanzcockpit für KMUs ersetzt Excel-Tabellen und manuelle Prozesse – damit deine Geschäftskund:innen ihre Finanzen stets im Blick haben und sich ganz auf ihr Kerngeschäft konzentrieren können. Es ermöglicht deinen Kund:innen einen kompletten Überblick über alle angebundenen Konten und sorgt so für mehr Transparenz über die Finanzsituation – Liquiditätsplanung wird so zur Nebensache.

Weiterlesen

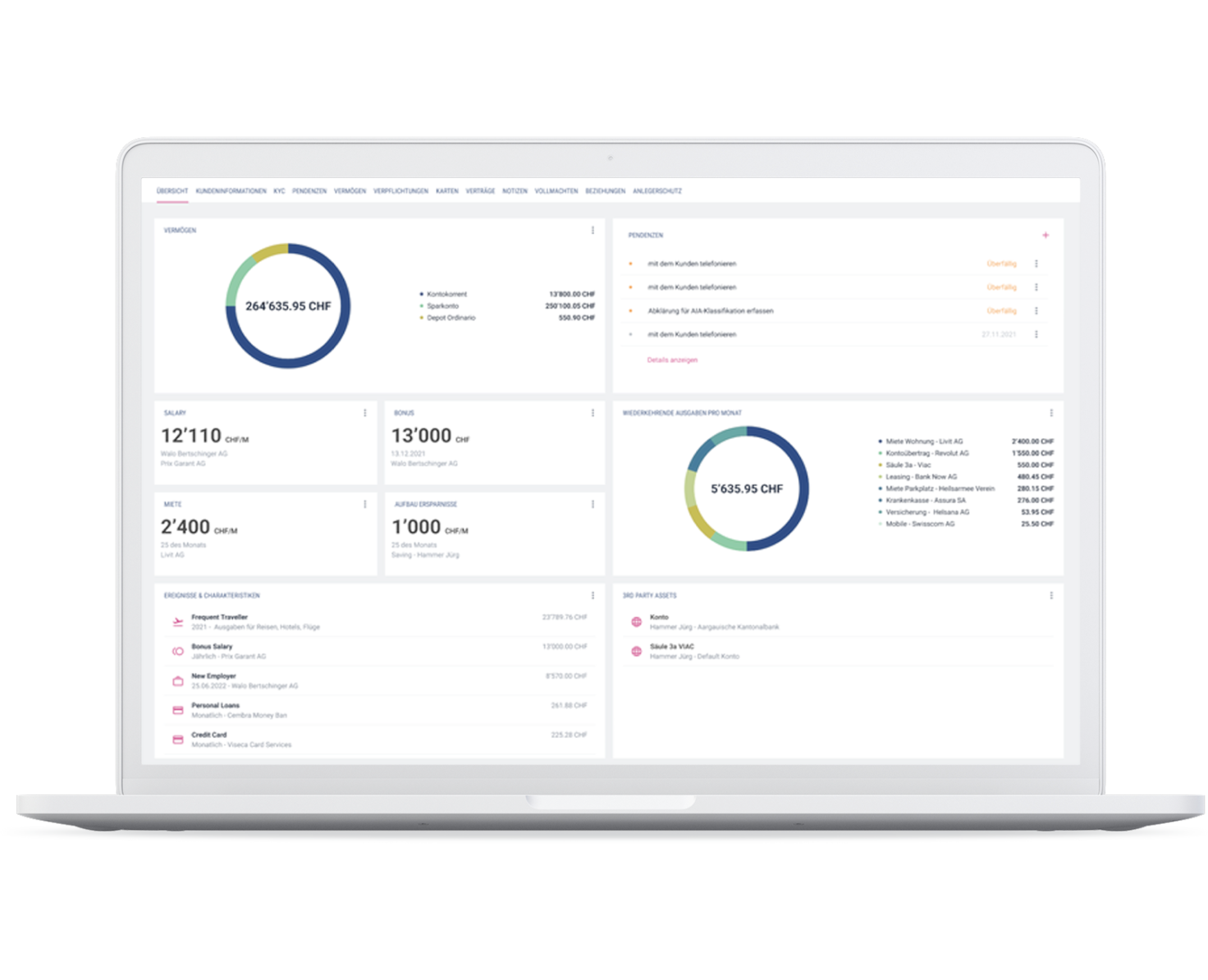

Enrichment Engine

Als On-Premise- oder als SaaS-Lösung integrierbar, strukturiert sie Zahlungsinformationen deiner Kund:innen und reichert diese intelligent mit Hilfe von Machine Learning mit relevanten Metadaten an. Du erhältst Einblicke in fast alle Lebensbereiche deiner Kund:innen und kannst darauf ausgerichtete Angebote und Empfehlungen mit höherer Abschlusswahrscheinlichkeit platzieren.

Weiterlesen

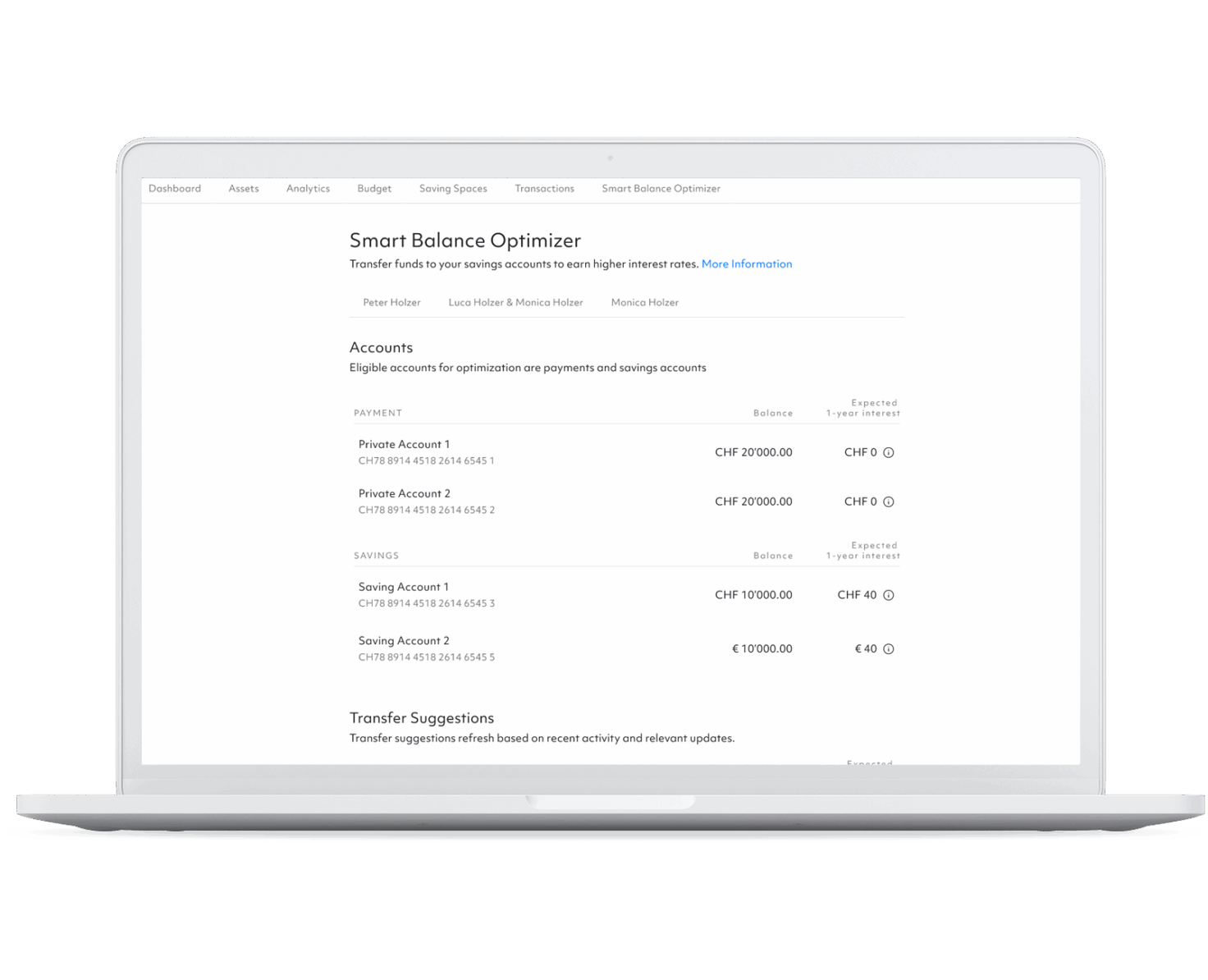

Smart Balance Optimiser

Der Smart Balance Optimiser nutzt erklärbare Agentic-AI, um freie Mittel auf den Kundenkonten optimal zu verteilen – mit dem Ziel, Erträge zu maximieren und gleichzeitig sicherzustellen, dass Geld jederzeit verfügbar ist. Er erkennt in Echtzeit Finanzmuster, prognostiziert den künftigen Liquiditätsbedarf und schlägt proaktiv Umbuchungen zwischen Konten vor.

Weiterlesen

Understand

Mehr Transparenz und ein besseres Verständnis der finanziellen Situation.

Coach

Zeitnahe, personalisierte und relevante Tipps zu Finanzen, direkt im Digital-Banking.

Enable

Tools und Insights unterstützen die Erreichung der finanziellen Ziele.

Was unsere Partner:innen sagen

Andreas Lenke

Projektleiter PFM bei der Thurgauer Kantonalbank

« Mit dem persönlichen Finanzassistenten bieten wir unseren Kunden gleich zum Start des neuen Portals einen grossen Mehrwert und können ihnen u.a. den Wunsch nach einer übersichtlichen und attraktiven Darstellung ihrer privaten Finanzen erfüllen. »

Bodo Grauer

Head Digital Strategy & Transformation, Avaloq

« Contovista ist einer der Stars der Schweizer Fintech-Szene und wir freuen uns sehr, viele gemeinsame – und sehr zufriedene – Kunden zu haben. Ihre Lösung ist ein Paradebeispiel für die Existenz von Fintechs: innovativ, wertschöpfend für die Kunden, einfach und schnell zu implementieren. Das Team hat einen guten Geist, eine positive und zukunftsorientierte Denkweise und ich genieße es sehr, mit ihnen zu arbeiten – es macht Spaß und man lernt immer. »

Christoph Wille

Leiter Vertriebskanäle und Mitglied der Geschäftsleitung bei der Valiant Bank AG

« Mit dem Multibanking Service reagieren wir auf die Nachfrage unserer Geschäftskunden nach einer Gesamtsicht über ihre Konten bei Valiant und anderen Banken. In Kombination mit dem BFM bieten wir hier einen in der Schweiz exklusiven Service, der es den KMU ermöglicht, auf einfache Weise bankübergreifend ihre Finanzen und ihre Liquidität im Griff zu haben. »

Dominik Gabler

Data Scientist bei der SZKB

« Die Lösungen im Bereich Analytik und Machine-Learning ermöglichen individuelle Kundenbedürfnisse zu analysieren, zu adressieren und gewonnene Erkenntnisse gewinnbringend einzusetzen. Contovista ist ein idealer Partner und Impulsgeber für die Schwyzer Kantonalbank und gibt uns regelmässig Denkanstösse, wie wir ungenutzte Geschäftspotenziale in der digitalen Welt ausschöpfen können. »

Dr. Simon Alioth

Managing Director, Synpulse8

« Finanzdienstleister stehen ihren Kundinnen und Kunden bei der Erreichung ihrer finanziellen Ziele mit Rat und Tat zur Seite. Contovista als starker Partner für Personal Finance Management bietet dazu einen passende, API-basierte Lösung für Finanzdienstleister. Mit der Präsenz von Contovista auf dem OpenWealth Marketplace von Synpulse8 erhalten Finanzdienstleister die Möglichkeit, massgeschneiderte Lösungen für ihre Kundinnen und Kunden zu entwickeln und ihren Bedürfnissen optimal gerecht zu werden »

Dr. Simon Youssef

Co-founder Neon

« Als junges Fintech waren wir auf der Suche nach einem dynamischen Produkt und neben der sauberen API Schnittstelle hat uns auch die schnelle und unbürokratische Zusammenarbeit mit Contovista von Anfang an überzeugt. »

Fabian Marti

Leiter Digital Solutions der Aargauischen Kantonalbank

« Die Digitalisierung erfasst alle Unternehmensbereiche und gewinnt in der Finanzbranche laufend an Bedeutung. Mit den Finanzassistenten von Contovista bieten wir unseren Privat- und Geschäftskunden daher zeitgemässe Erweiterungen im AKB Portal. Die Services wurden sofort positiv von unseren Kunden angenommen und machen digitales Banking noch persönlicher. »

Mike Hofmann

Senior Product Manager für bLink bei SIX

« Mit ihrer führenden BFM- und PFM-Lösung trägt Contovista wesentlich zur Mission von bLink bei, OpenAPI-basiertes Multibanking für Firmen- und Privatkunden bei Schweizer Finanzinstituten zu etablieren. Wir schätzen den pragmatischen und pionierhaften Ansatz des Teams sehr und sind überzeugt, dass durch solche technischen Kooperationen ein synergetisches Open-Finance-Ökosystem geschaffen wird, von dem die Schweizer Finanzindustrie profitiert. »

Niclas Persson

CEO & Co-Founder – Deedster

« Contovista ist der unangefochtene PFM-Marktführer in der Schweiz. Wir sind sehr stolz darauf, mit ihnen zusammenzuarbeiten, da sie mit dem Carbon Footprint Manager Nachhaltigkeit zu einer zentralen Funktion in ihren Finanzmanagement-Lösungen der nächsten Generation machen. »

Roland Zwyssig

Viseca Payment Services SA, Senior Advisor

« Die Zusammenarbeit mit Contovista kann etablierten Finanzinstituten helfen, schneller innovative Dienstleistungen und Funktionen einzuführen. Die Viseca ist bestrebt, bei der Digitalisierung der Kreditkarte eine Vorreiterrolle zu spielen und gemeinsam mit Partnern aus dem Fintech-Bereich Mehrwerte für die Partnerbanken wie auch Kreditkartenkunden zu schaffen »

Stefanie Feigt

CEO 3rd eyes analytics

« Wir freuen uns sehr, mit Contovista zusammenzuarbeiten. Ihre innovativen Produkte, die schnell und einfach zu implementieren sind, ergänzen unsere Lösungen zur individuellen Vermögensplanung ideal. Die Kombination unserer beiden Produkte bietet einen enormen Mehrwert für unsere Kunden und wir freuen uns, zukunftsorientierte Services für Finanzdienstleister gemeinsam anbieten zu können. »