Sustainable Banking for Swiss Banks

Sustainability is the dominant concern of our time, in the financial sector as well.

Banks could play a key role in the transformation towards more sustainability. In addition, sustainability has major consequences for their business model, for example for risk management, market presence or financing. How can we make sustainable banking work?

- What Is Sustainable Banking?

- Why Banks Must Act Now?

- Success Model of “Eco-Banks” – How Can Financial Institutions Follow Suit?

- The Carbon Footprint Manager for Sustainable Banking in Practice

- Practical Sustainability Tips for Swiss Banks

- Sustainable Banking with Contovista: The Solution from the Swiss Specialist

1.What Is Sustainable Banking?

Banks can leverage sustainability as an opportunity to enhance market positioning, customer loyalty, and revenue growth. What are the consequences for your business model?

It has long been recognised that sustainability is the major issue of our time, with climate change probably the most urgent challenge facing humanity today. But what does this mean for the financial sector? Like many other industries, banks are under intense pressure to become more sustainable.

Sustainability Pays Off – Especially for Banks

Nevertheless, more and more banks are considering this an excellent opportunity rather than a threat. After all, sustainable banking opens up important potential for financial institutions: they can position themselves positively in society, strengthen their brand, and increase customer loyalty while simultaneously generating crucial additional revenue growth by offering new products and services.

Finally, the sector has a particularly vital role to play in achieving sustainability goals, as the authors of this study argue:

Decisive Consequences for the Business Model

Sustainable banking is also of paramount importance for the business model of banks themselves – as expressed by the majority of the institutions surveyed in the above-mentioned study. 51% believe that their “current business model should be oriented towards eco-banks in the future”. In the individual areas of the business model, this figure is as high as 70% to 80%. In fact, the consequences are considerable on several levels:

Financing

By granting loans, banks have an influence on implementing sustainable projects, purchases, and investments – whether in the economy or for consumers. They also make a huge contribution to financing in the investment sector (e.g., sustainable ETFs).

The same applies to issuing business (green bonds etc.). According to a McKinsey study, the sales potential of sustainable financing could exceed $100 billion per year by 2030.

Risks

Sustainability risks pose new challenges for the risk management of banks. These include physical, transitory, and greenwashing risks that primarily affect corporate customers and therefore banks themselves. The German Federal Financial Supervisory Authority (BaFin) addressed sustainability risks in the financial sector in a 2021 status survey.

Market Presence

Banks must not only act more sustainably; they must also communicate that they are doing so. Public perception, stakeholder dialogues, and the marketing strategy must be adapted accordingly. A study entitled “Sustainable Banking” revealed that 80% of the institutions surveyed attribute very strong or rather strong influence to this aspect.

Business operations: Like all companies, banks need to make their operations more sustainable, e.g., through energy-efficient buildings, IT technology, and vehicle fleets.

51 % believe that “their current business model should be oriented towards eco-banks in the future.”

Sustainable Growth: The Long-Term Potential

Amid the aftermath of the coronavirus crisis and the significant increases in interest rates by central banks, banks across the globe have recently seen a recovery in sales growth and margins. According to the McKinsey study already cited, however, this could well turn out to be a rather short-term effect.

It is therefore necessary to lay the foundations for long-term growth today, for which the area of sustainability is particularly important in McKinsey’s view. Support is also coming from the political arena. According to a recent report by the State Secretariat for International Financial Matters (SIF), important areas for action include sustainability data and the technology of green FinTechs, greenwashing and transparency as well as impact investments and CO₂ pricing.

2. Why Banks Must Act Now

Whether it’s the consequences of climate change, legislation, or corresponding customer expectations in terms of sustainable finance: sustainable banking is definitely a priority.

The pressure to act with regard to sustainability could hardly be any greater. If global warming caused by the greenhouse effect cannot be limited to 1.5 degrees in 2100 as compared to the pre-industrial era, humanity and the entire planet will face devastating consequences.

At the COP27 Climate Change Conference in 2022, this goal was reaffirmed by the global community. To achieve this, the Federal Council is aiming for net-zero status in greenhouse gas emissions by 2050.

High Regulatory Pressure

This high degree of urgency applies especially to companies in the financial sector – purely from a regulatory perspective. Relevant laws and regulations have been enacted internationally and nationally or are still being planned. In Switzerland, for example, climate reporting in accordance with TCFD will be required of large companies from 2024.

In the EU, disclosure requirements apply under the Corporate Sustainability Reporting Directive (CSRD), which replaces the previous requirements (NFRD), and in general the EU taxonomy regulation. Among other things, reporting on KPIs such as the Green Asset Ratio (GAR) is particularly relevant for banks. In a financial context, possible disclosure requirements under Basel Pillar 3 must also be taken into account.

Alongside the regulators, investors and shareholders are increasingly demanding proof of sustainable business practices, e.g., based on ESG scores from rating agencies.

Customers Want Sustainable Banking

However, it’s not only regulatory and other institutions that are exerting strong sustainability pressure on banks; it’s customers as well! Consumers’ beliefs, habits, and preferences are also increasingly evolving in this direction. They not only expect companies in the financial sector to offer sustainable products and adapt their operations accordingly; they also want to make their own active contribution to achieving sustainability goals.

This also applies explicitly to consumers’ private financial transactions, as Contovista’s consumer study demonstrates. 52% of respondents would like their bank to help them do more for the environment. What’s more, participants are placing further high demands on sustainable banks: they should offer fair working conditions (42%), distribute sustainable financial products (39%), and comply with high environmental and social standards themselves (37%). Against this backdrop, sustainable banking is a top priority for Swiss banks.

3. Success Model of “Eco-Banks” – How Can Financial Institutions Follow Suit?

The proven model of “eco-banks” is increasingly putting traditional banks under pressure. Cooperation with FinTechs delivers fast results and a credible sustainability profile.

Sustainable banking is a matter of the utmost urgency – and has long since arrived on the market. Sustainable banking is by no means a utopian vision, but a tried and tested business model that “eco-banks” have been successfully implementing for decades.

A Proven Business Model

Pioneers such as the German GLS Bank started as early as the 1970s by providing loans for socially beneficial projects. The characteristics of such banks include restricting themselves to sustainable investments or helping customers to live in a more sustainable manner. In the beginning, such banks were not taken very seriously by established competitors. Yet their results are convincing: strong long-term growth in balance sheet totals, increasingly satisfied customers, and a more than competitive level of service.

Today, more and more new providers are joining the ranks: start-ups, neobanks, and smartphone banks, such as Tomorrow Bank in Germany. In Switzerland, Alternative Bank offers sustainable banking, while Radicant Bank is also planning a similar offering.

Traditional Institutions Under Pressure

For established banks, sustainable competitors are further intensifying the pressure to act in terms of sustainability. Traditional banks must respond to this and take inspiration from new players in terms of their product strategy and market presence. The majority of banks have also recognised this. In the “Sustainable Banking” study, 51% of the banks surveyed said they wanted to take their cue from eco-banks when developing their business model in the future.

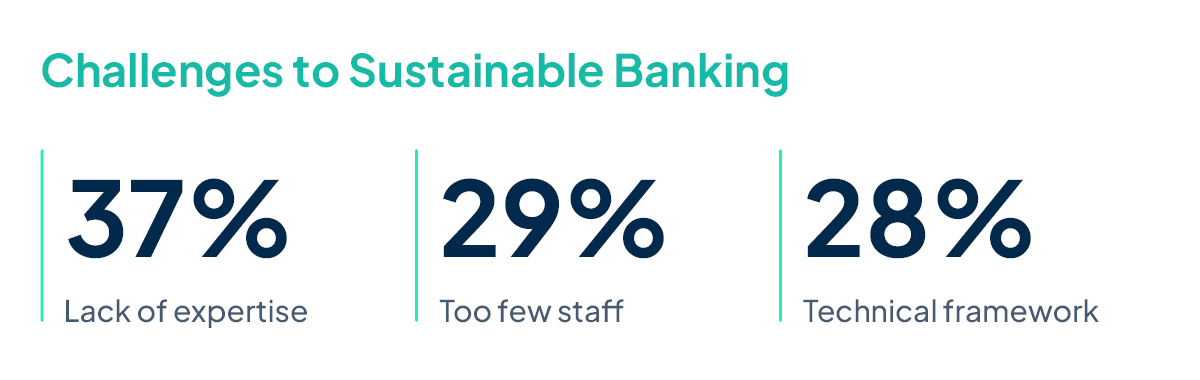

But how should they proceed in practice? Well, there are a number of hurdles to overcome when setting up sustainable banking.

Success Through Cooperation

To achieve rapid results, we recommend you work with external service providers who demonstrate the relevant expertise. The topic of sustainability is generally well suited for outsourcing, as the “Sustainable Switzerland” initiative explains in this article. This applies to areas such as data collection, analytics, reporting, and compliance.

Proven solutions are also already available in the financial sector, allowing banks to quickly put tangible sustainable offerings on the market for their customers. In this context, data-driven sustainability applications provided by FinTechs such as Contovista, for example, are particularly promising. They can be quickly and easily integrated into a bank’s offering to improve its sustainability profile.

4. The Carbon Footprint Manager for Sustainable Banking in Practice

The innovative tool for banks to calculate the carbon footprint from account transactions and implement sustainable measures. Seamless integration, user-friendly, and effective.

Banks have a whole range of areas to address on their journey to sustainable banking. A particularly effective approach is one in which an institution supports its customers in acting against climate change themselves. After all, many consumers want to act, shop, and live in a more sustainable manner. With the recently released Carbon Footprint Manager, banks pick them up exactly where this is best managed, namely in their private accounts used to pay for their everyday purchases.

The Carbon Footprint Manager is an optional module of the Personal Finance Manager (PFM), Contovista’s control centre for personalised data-driven banking. The tool calculates users’ carbon footprint and provides them with climate information on all account transactions as well as additional tips and insights. This makes it a must-have feature for banks that want to become more sustainable and more relevant to their customers.

Detailed climate info: Discover how transaction-based CO₂ calculation works

Understand

Personal CO₂ footprint based on transactions compared to the Swiss average

Coach

Personalised tips with gamification elements to lowering CO₂ emissions

Enable

Achieve sustainability goals with sustainable budgets and cross-sell to the bank’s sustainable products

A Meaningful Basis: Swiss Data

The CO₂ calculations are based on Swiss climate data provided by Contovista’s partner Deedster, a leading Scandinavian specialist in sustainability data. More than 90 data sources and methods are used for the individual calculations. The results are approximate values that provide a solid foundation for effectively assessing your own climate contribution.

The Swiss database also allows users to see their carbon footprint compared to the Swiss average. The user interface provides this information, if relevant, with supplementary positive feedback messages. However, this is only one of many gamification elements in the Carbon Footprint Manager.

Read how Deedster and Contovista work together to achieve greater sustainability in banking.

Playfully to more Sustainability: Gamification & Education

To support customers in actively protecting the climate, the Carbon Footprint Manager gives users six personalised tips each month that are both practical and effective (such as having vegetarian dinners).. The tips are individually selected based on the transaction analysis and contain information on the potential CO₂ savings.

The management of tips is convenient and playful: users can check them off once complete, bookmark them, and delete them. Up to 12 new tips are offered each month. When a tip is accepted, a success screen is displayed as feedback, including information about the impact it will have on their carbon footprint.

Contovista’s approach to personalised data-driven banking is Understand. Coach. Enable – and the Carbon Footprint Manager is no exception. The module gives customers an understanding of their CO₂-footprint (understand), tips on how to reduce it (coach), and enables them to implement their sustainability goals concretely as part of online banking or the PFM (enable).

Three different direct actions are offered:

- Create a budget to better control expenses and emissions

- Set up a saving space to save towards sustainable purchases

- Invest in a sustainable manner via a link to a suitable bank’s investment page

Sustainability competency with the Carbon Footprint Manager

Contovista’s Carbon Footprint Manager allows bank customers to calculate their carbon footprint directly from their account transactions, without the need for a separate app or manual data entry.

Integration into online banking via APIs makes implementation straightforward for banks, offering them the opportunity to strengthen their sustainability profile, boost customer loyalty, and position themselves as pioneers in the field of sustainable banking.

5. Practical Sustainability Tips for Swiss Banks

Sustainable banking should be both authentic and transparent. Clear goals and customer involvement are indispensable. This is how banks implement it today.

Sustainable banking is urgent from an ethical perspective and makes a lot of business sense – meanwhile, eco-banks are leading the way. Established institutions on a mission towards sustainability can learn a great deal from them. In most cases, these providers set strict sustainability targets and guidelines. Equally often, they rely on a communication strategy that communicates the bank’s goals and values to customers in a clear and understandable way.

In doing so, banks must first ensure that customer communication itself is also “sustainable” in terms of its authenticity, transparency, and honesty.

Messaging should be personalised and closely aligned with the values of the bank’s customers.

5 Measures for Holistic Sustainability

-

Define sustainability goals

Banks should set out their sustainability goals in writing and make them easy for customers to understand in attractive visual presentations. In doing so, they can be guided by the Sustainable Development Goals of the United Nations. For example, GLS Bank has 10 strategic and 50 operational goals, which are presented in an attractive dashboard for customers.

A detailed sustainability report that highlights successes and challenges each year and is offered as a download can also be useful. In addition, organisational control of compliance with sustainable criteria, such as through an environmental council, can be emphasised in communications.

-

Formulate positive and exclusion criteria

What does the bank want to promote with its lending and investment business, and what does it want to avoid? There are regulations on this, e.g., regarding disclosure, which are of course extremely important, but at the same time they are often quite complicated. For customers, the most important thing is that the criteria are clear and tangible. Investment and financing principles should be communicated concisely, covering topics such as renewable energies and sustainable business, but also on excluded areas such as nuclear power or armaments.

-

Communicate positive impact

Do good and talk about it – this principle also applies to sustainability. This way, customers recognise the success of the bank’s activities based on their deposits and investments. For example, Tomorrow Bank presents selected impact highlights such as “35,116,071 litres of clean drinking water in Eritrea”. Umweltbank presents sustainable projects that have been financed in detail on its website. GLS Bank also provides detailed information such as 15,000 single-family homes equipped with photovoltaics, 98t CO₂ avoided through renewable energy, 41,445 sqm of additional space for educational institutions.

A concrete list of facts and figures provides a quick overview of the impact of sustainable banking.

-

Engage customers with activities

Banks should support their customers in doing something for the environment themselves. A campaign based on card usage is a good, low-threshold option for this. The Swiss neon bank plants a tree for every CHF 100 spent on the neon green account card – a small contribution to reducing CO₂ in the atmosphere. The bank contributes an additional 5 trees per month. Tomorrow Bank has even set up its own system for this in the form of wheelbarrows, i.e., eco-units for sustainable purposes. Wheelbarrows are distributed with every card payment, with 5 euros equalling 1 wheelbarrow.

-

Shape sustainability down to the finest detail

Even supposedly small things contribute to achieving sustainability goals. For example, when it comes to paying with “plastic money” – while at the same time plastic waste is causing enormous problems in the oceans. That’s why neon bank offers its neon green customers a Mastercard made of cherry wood, and ING recently followed suit with cards produced from plastic waste from the ocean. Traditional banks with branches also have many options when designing their premises to implement their environmental standards by using sustainable materials.

6. Sustainable Banking with Contovista

With the Carbon Footprint Manager, Contovista offers Swiss banks a tailor-made solution for sustainable banking, customer loyalty, and climate protection.

On the road to sustainable Banking

Swiss banks can take a giant step towards sustainable banking with Contovista’s Carbon Footprint Manager. This tool consistently follows our approach Understand. Coach. Enable. In other words, we help institutions support their customers. As specialists in data-driven banking, we have a wealth of experience in analysing and enriching transaction data, which provides us with the basis for sustainability insights and sustainable actions in private accounts.

In doing so, we rely on external expertise in the form of the CO₂ solution provided by the sustainability professionals at Deedster. If you want to learn more, Deedster describes the background to our cooperation in this case study. In a nutshell, however, our data-driven Personal Finance Manager (PFM) made us the Swiss market leader in data-driven banking. And now we want to extend this product with additional features that would be even more in line with our Understand. Coach. Enable approach. We had already enjoyed great success with such features in our offering for SMEs, namely the Business Finance Manager (BFM) – e.g., with advanced liquidity analyses and forecasts. In the retail sector, we have followed suit with the Carbon Footprint Manager.

This way, banks can position themselves first and foremost on the issue of climate protection. In addition, the Carbon Footprint Manager helps them drive customer engagement and strengthen customer loyalty. By offering such services, they underpin their claim as a house bank of being a reliable partner to their customers in their day-to-day financial dealings.

Banks are ideally positioned to do this because they already have the necessary (account) data and customers already have the necessary trust in them to handle their data in a responsible manner. After all, customers still regard their bank as a sound, reliable institution.

According to a survey conducted by the Swiss Bankers Association, 90 percent of Swiss people have a positive or very positive view of their main bank.

This trump card must now be played so that established institutions can hold their own against new competitors. Contovista’s Carbon Footprint Manager is an important building block for this. Our sales team can provide further information and personalised advice.