Sustainability is THE megatrend of our time. However, calling it a “trend” may not really do justice to the existential urgency of climate change. The latest interim report by the Intergovernmental Panel on Climate Change (IPCC) underscores the profound seriousness of the situation: global greenhouse gas emissions must fall by 50 percent by the 2030s in order for the 1.5 degree target to remain attainable. Put simply, this won’t happen without behavioural changes.

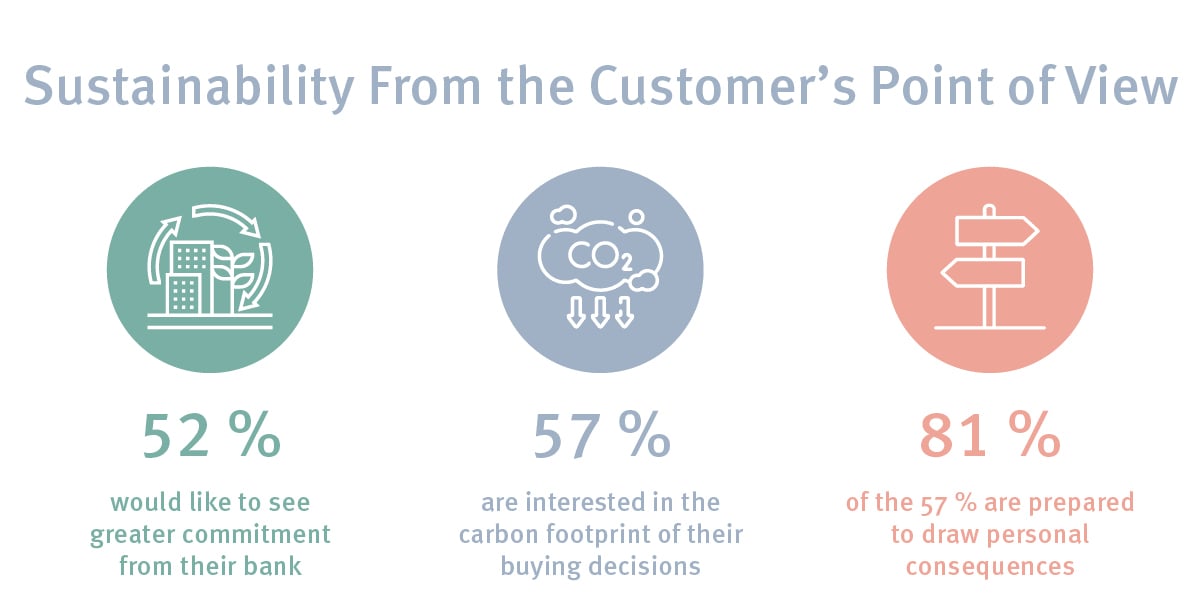

The good news, however, is that this message is now clearly resonating with consumers, and not just with Millennials either. More and more people want to make a positive contribution by making more sustainable choices. Yet given the complexity of the issue, it can quickly become overwhelming for individuals on a day-by-day basis.

Read here how banks and financial institutions are helping their customers to adopt more sustainable behaviours and position themselves as competent, relevant partners with purpose-driven banking. The key to all this is data-driven solutions that determine a customer’s carbon footprint.