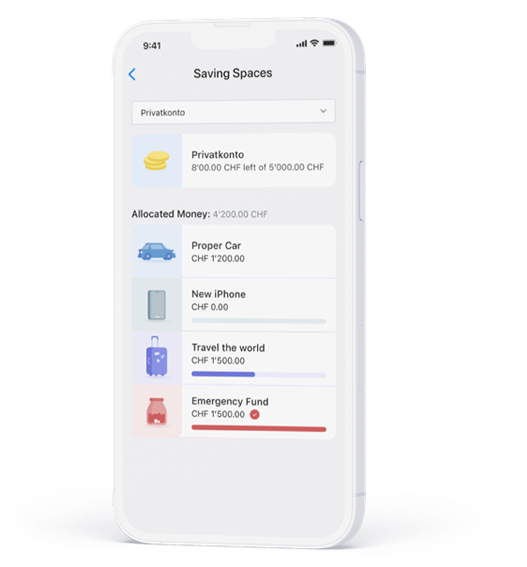

Das Feature zur Geolokalisierung – also die Ortung, wo eine Kartenzahlung stattgefunden hat – wurde komplett redesigned und deutlich verbessert. Neu können genaue Standortinformationen zu Händler:innen in der Schweiz angegeben werden. Zusätzlich bietet das Feature die Möglichkeit, die Händler-Koordinaten auf einer Karte darzustellen. Unser Framework zur Geolokalisierung ist so flexibel aufgebaut worden, dass es uns erlauben wird, fortlaufend Händler auch aus dem Ausland orten zu können.

Zu Kreditkartentransaktionen liegen normalerweise ausser Ort oder Postleitzahl keine weiteren Adressdetails vor. Pro Händler wird meist nur eine Adresse unterstützt (typischerweise der Hauptsitz). Unser Geolocation Feature liefert exakte Standortinformationen, wie z.B. den genauen Standort der Filiale, in der eine bestimmte Transaktion stattgefunden hat.

Die Erweiterung des Geolocation – Feature beinhaltet:

- Angabe der Koordinaten (Längen- und Breitengrad) der Kartentransaktionen, die physisch (d.h. ohne E-Commerce) in der Schweiz stattgefunden haben.

- Unser Zusatzservice für dich: Koordinaten auf einer Karte anzeigen lassen, die auch in andere Applikationen integriert werden können.

The geolocation feature, which shows the location of a card payment, for example, has been completely redesigned and significantly enhanced. Precise location information on merchants in Switzerland can now be entered. In addition, the feature offers the possibility to display the merchant coordinates on a map. Our geolocation framework has developed so flexibly that it allows us to locate merchants from abroad as well.

Credit card transactions usually have no address details other than city or postcode. Only one address is usually supported per merchant (typically the head office). Our geolocation feature provides exact location information, such as the precise location of the branch where a particular transaction took place.

The extension of the geolocation feature includes:

- Indication of the coordinates (longitude and latitude) of the card transactions that took place physically (i.e., excluding e-commerce) in Switzerland.

- Our additional service for you: display coordinates on a map that can also be integrated into other applications.