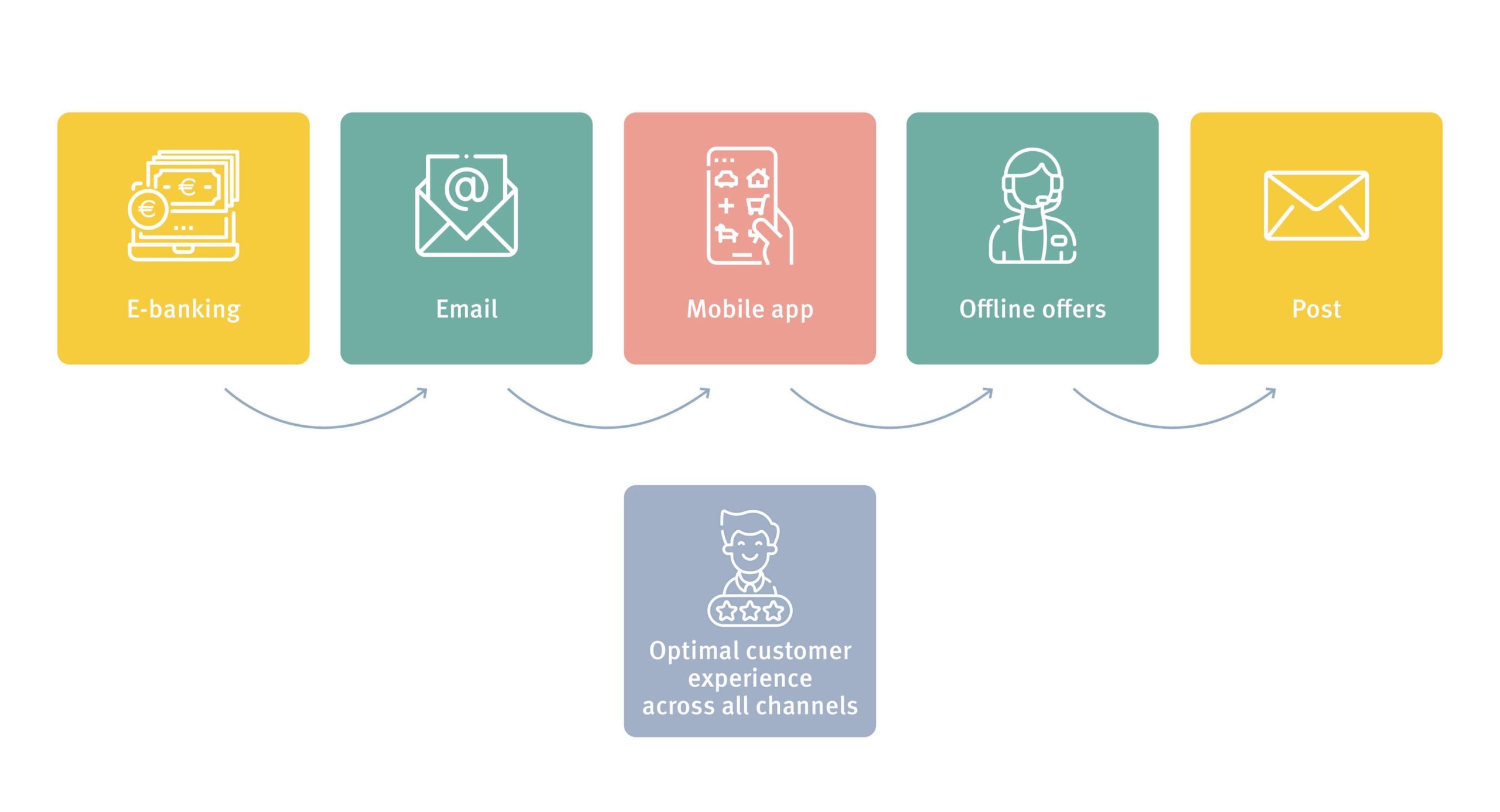

The use of e-banking and digital channels is rising dramatically. However, for many bank customers, going into the branch is still the preferred option, or at least regarded as a meaningful point of contact. How can banks implement a profitable omnichannel strategy that includes all interaction channels?

Once again, the answer is data. As mentioned earlier, banks have a clear advantage due to the sheer wealth of data they possess. Increasing the number of touchpoints doubles this advantage. By analysing and enriching all existing data — from e-banking, the website, the mobile app, emails and data from offline offerings such as customer advisory services — banks generate even more knowledge that can be used in an optimised way.

The high-quality data derived from digital and physical touchpoints can also be used to consistently design and enhance the customer experience across all channels, as well as to offer in-demand products and streamline frontend and backend processes.