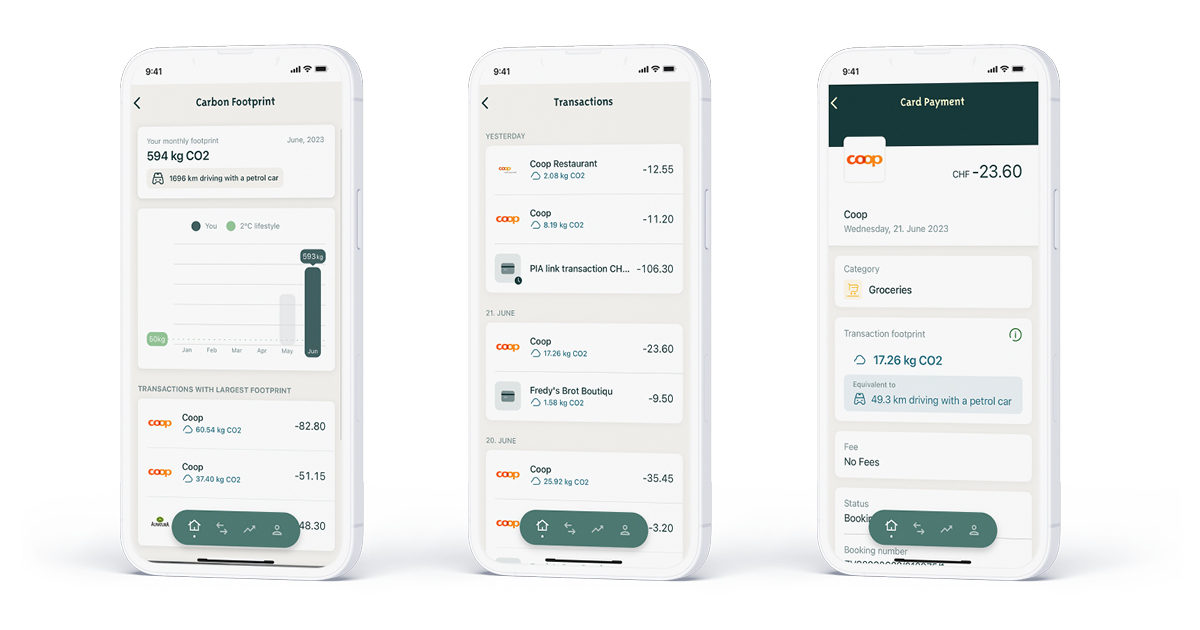

Contovista’s Carbon Footprint Manager is just the right tool for the job. It is based on the analysis and most precise categorisation of account transaction data. The merchant is automatically recognised, enriched with “pretty names”, while the correct merchant logos are displayed automatically. Furthermore, the algorithm also assigns the correct spending and consumption categories in an automated manner.

This transaction data is then linked with high-quality, research-based climate data. To achieve this, we collaborate with our partner Deedster, a Scandinavian specialist in data-driven sustainability solutions. By utilising national reference values for various categories, we calculate the CO₂ contribution of each transaction, ranging from supermarket purchases to flight tickets. This process involves the use of over 90 methods and data sources.

The calculated CO₂ values can be processed and utilised in various ways. For instance, bank customers can compare their monthly CO₂ balance with the 2-degree climate targets.

By using the Carbon Footprint Manager, users are empowered to take sustainable actions on their own. The transparency of the carbon footprint allows consumers to effectively adjust their behaviour and make more environmentally-conscious decisions.